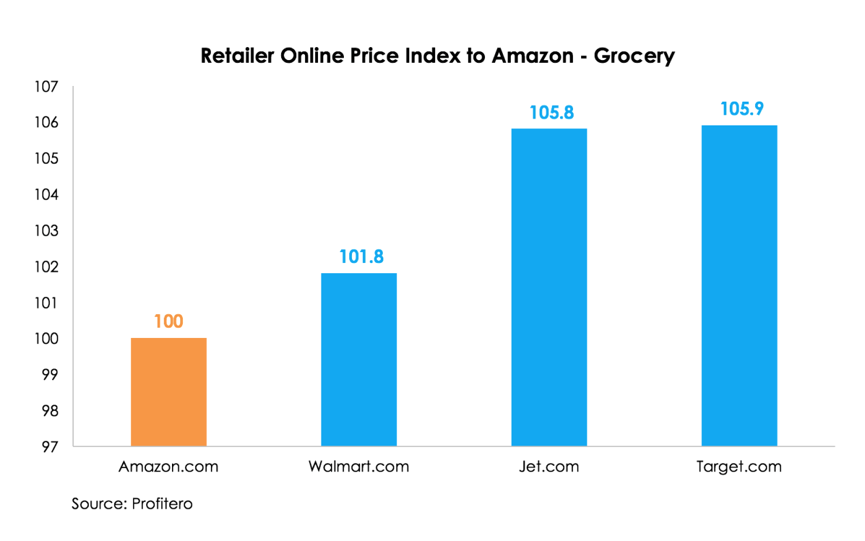

Profitero study finds less than a 2% gap between Walmart and Amazon’s pricing on grocery products; Target and Jet.com come close, but continue to trail

BOSTON, 27 February 2018. Walmart online grocery prices are edging closer to Amazon, with only a slim gap separating prices between the two retailers, according to a new study by global e-commerce analytics firm Profitero.

In the report, Price Wars: Grocery, Household & Beauty, Profitero analyzed pricing for 21,000 products in grocery, beauty and household supplies, finding only a 1.8% average difference between Walmart's and Amazon's prices for grocery. Target and Jet.com were both found to be, on average, about 6% higher in grocery than Amazon.

The latest study builds upon research Profitero released in October 2017 when the company compared online price differences for 13 key non-CPG categories across Amazon, Walmart, Target, Jet.com, and other retailers and found that Walmart prices were among the most competitive to Amazon, with an average price difference of 3%. Furthermore, the tighter gap in CPG prices across retailers suggests that CPG categories overall are more prone to price wars with Amazon than non-CPG categories.

Other key findings from the report:

- Walmart is getting aggressive with price matching. The retailer matched Amazon prices on 53% of all CPG products studied, and 67% in grocery.

- The Amazon Prime Pantry program is paying off, helping create price separation from the competition. Prices on products listed in the Prime Pantry program average about 11% less than those found at other retailers.

- Amazon regained its price lead over Walmart in beauty compared with Profitero’s October findings. Jet.com is now nipping at Amazon’s heels in the beauty category with a price gap of just 1.4% between the two. Walmart beauty prices averaged about 5% more, while Target was almost 7% higher.

- Specialty retailers continue to lose ground in the battle for price supremacy. Online beauty prices at Walgreens.com and CVS.com averaged about 30% higher than Amazon.

“Amazon still reigns as the low-price leader online, but it’s evident that Walmart is making grocery a key battleground for challenging that leadership,” said Keith Anderson, SVP of Strategy & Insights at Profitero. “Our latest study confirms that price gaps in online grocery are much narrower than what we found to be the case across other non-grocery categories. Walmart is clearly positioning to win shopper loyalty through aggressive pricing on everyday household essentials.”

The full report, Price Wars: Grocery, Household & Beauty, can be downloaded here.

Methodology Summary

Profitero analyzed daily prices collected from September 1, 2017 to November 30, 2017 at Amazon.com, Jet.com, Target.com and Walmart.com across the Beauty, Grocery and Household Supplies categories. In total, 21,939 Amazon products were monitored and matched across these retailers. Prices at CVS.com and Walgreens.com for Beauty and Homedepot.com for Household Supplies were also monitored. The study only compares prices collected on the same day, with both retailers in-stock. Amazon prices reflect 1P only on Amazon.com, exclusive of Fresh and Prime Now. The other retailer online prices studied could reflect promoted prices, but exclude coupons, other discounts that require additional shopper action, or special prices available through retailer-specific programs like Target REDcard or Jet Smart Cart.

About Profitero

Profitero helps brands grow their online sales faster. With our solution, brands can benchmark their complete digital shelf performance against any competitor, across any global retailer site or mobile app, in real-time. Only Profitero can link digital shelf performance to increases in sales and market share, allowing brands to achieve better focus and ROI from their optimization. Many of the world’s leading brand manufacturers and retailers depend on Profitero’s granular and highly-accurate data to measure and improve their e-commerce performance. These include Barilla, General Mills, L’Oreal, Beiersdorf, Del Monte, Sam’s Club, Waitrose, Ocado, and Delhaize.