Profitero's annual Price Wars study unveils the competitive UK retail landscape during the 2023 Cost of Living Crisis

Report findings include:

-

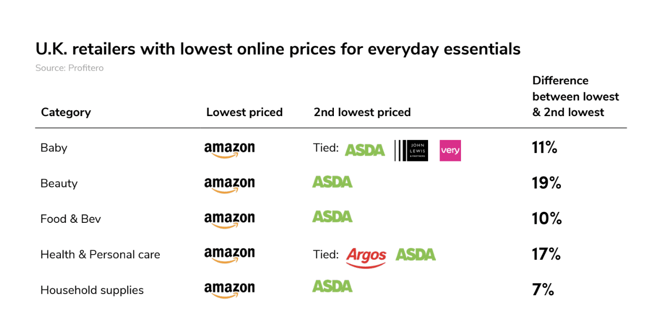

Amazon is 14% lower in price on average than online competitors, extending its price lead in all 16 categories

-

Asda is the closest competitor in beauty to Amazon, 19% behind in price

-

4 in 10 shoppers consult a retailer’s app or website before purchasing in-store

-

Amazon leads on price against all UK supermarkets by almost a third (29%+) on popular festive drinks such as Baileys

-

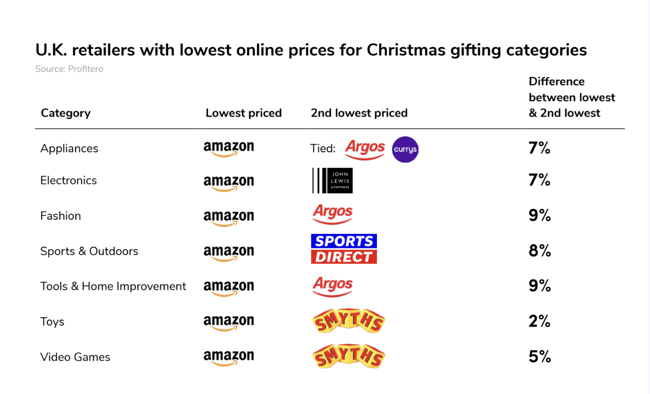

Toy Retailer, Smyths, is only 2% more expensive than Amazon for toys and 5% on gaming

-

Christmas advert heavyweight John Lewis is only 7% behind Amazon prices for electronics

-

Top U.K. grocers, Sainsbury’s and Tesco lagged most with prices that were 19% and 16% more expensive than Amazon in packaged food & beverages

As the UK gears up for heightened consumer spending during the upcoming Black Friday and Christmas shopping season, commerce analytics platform Profitero has released its annual Price Wars study looking at the competition across the UK retail landscape. The research focuses on 18 leading retailers including John Lewis, Asda and Amazon for 9,700 items across 16 categories.

Whilst findings this year uncover online retail giant, Amazon, leads again on price (with average prices 14% less expensive than rivals), UK’s other major retailers are not giving up. The fourth Profitero report outlines how British favourites such as Argos and Smyths have priced their products in comparison to keep up.

As the Cost of Living Crisis affects British shoppers, consumers are being extra thrifty this festive season.

Those looking for the best deals may be tempted by Amazon’s low prices however Smyths’ prices for toys and video games were only 2% and 5% higher, respectively, offering an affordable option for gift-buyers who prefer to touch and feel products ahead of purchase.

Well-established household brands in other categories are also not far behind Amazon. John Lewis is only 7% more expensive on average for electronics. Once known for its price match tagline, “Never Knowingly Undersold” which the brand had to drop due to the online competition, John Lewis holds the advantage of brand trust, which some may consider worth the price difference.

Popular holiday beverages like Moet, Gordon's Gin, Baileys, and Disaronno are essential for Christmas gatherings. Savvy shoppers preparing for Christmas can find Amazon offers significant cost savings compared to leading UK supermarkets, with Baileys being the standout example, priced 29% lower than Asda, Ocado, and Sainsbury's, who share the second spot

The UK's consumer culture typically values brand loyalty, but the rising cost of living and increase in online shopping are prompting shoppers to change their habits. The Profitero report highlights that nearly 40% of shoppers now check a store's website for prices and deals before shopping in person, indicating a shift in their behavior.

Profitero’s report coincides with recent research by Pricer, which found that the vast majority of grocery shoppers (92%) claim to be conscious of price when food-shopping and nine in ten (87%) actively seek out discounts when grocery shopping. ShipEngine and Retail Economics also found that in 2023, 79% of UK consumers plan to cut back on non-food spending related to Black Friday and Christmas — a 9% increase from the previous year.

To read this year’s report and to find out more about how retailers compare in price, please visit: https://www.profitero.com/report/price-wars-uk-2023

Notes to Editors

Only identical items available and in-stock in the same pack configuration were compared. Data was collected daily over 12 weeks (July 10 - Oct 1, 2023), with daily prices averaged over the full period for comparison. Prices for the same items were collected within 24 hours of each other to ensure validity of the comparisons. To refer to past Profitero Price Wars studies, please go to: profitero.com/insights.

Retailers featured in the study included: Amazon UK, Argos, Asda, ASOS, Boots, Currys, B&Q John Lewis, Morrisons, Next UK, Ocado, Sainsbury’s, Smyths Toys, Sports Direct, Tesco, Very, Zalando and Zooplus.

About Profitero

Profitero is the leading global commerce acceleration company offering a flexible suite of intelligence-driven solutions so that brands can grow profitably. Their integrated digital shelf analytics, shelf-intelligent activation and advisory services empower brands to optimise product availability, discoverability, and maximise conversions across 1,200+ retailers and 70 countries. www.profitero.com