Total U.S. CPG industry sales reached $962 billion in 2021, up 2.7% on top of unprecedented 10.6% growth in 2020, according to the latest Growth Leaders in CPG report by market research firm IRI.

Key insights:

- CPG sales growth in 2021 was driven primarily by price increases (i.e., inflation).

- Worth noting: Large brands saw a slight share gain in 2021 — the first time this has happened in 5+ years. Small brands also saw share gains. Growth came at the expense of private labels.

- Category trends reflect some return to pre-COVID consumer behavior, but also give us an indication of what’s sticking or accelerating as a result of the pandemic:

- Categories on the decline: Stock-up / pantry-load categories like Dry Goods and Frozen, as eating out/foodservice experience a resurgence

- Accelerating/Sustained trends: Self care; Household & personal care; Fresh & perimeter foods; Convenience (Read our Quick Commerce blog)

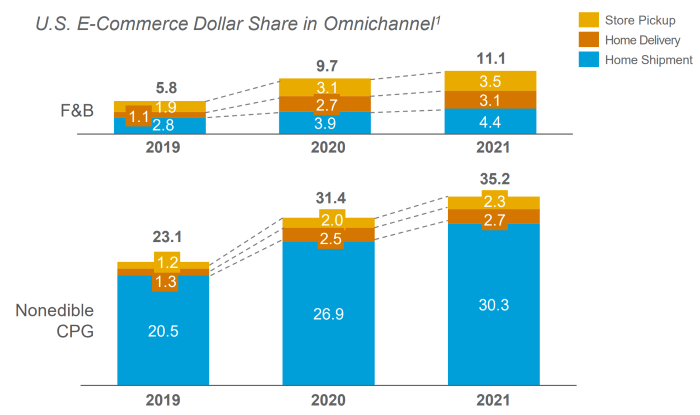

- CPG eCommerce penetration (including omni, Pure Play and DTC) continued to grow in 2021.

- Non-edible CPG dollar share reached 35.2%, up from 31.4% in 2020 and 23.1% in 2019. Ship-to-home is the dominant model for non-edible CPG.

- Food & Bev share almost doubled in 2 years, from 5.8% in 2019 to 11.1% in 2021. But unlike non-edible CPG, store pickup and local delivery play a much bigger role for Food & Bev online order fulfillment.

CPG eCommerce penetration continued to grow in 2021

Source: Growth leaders in CPG 2021 report, IRI and BCG

So what? Now what? What does it mean for brands?

- Make sure your products shine online. As CPG sales continue to shift online, it becomes critical for brands to have best-in-class online product content, positive ratings & reviews, and a solid in-stock position (i.e., your products are available). Profitero’s app can help you quickly and efficiently track your digital shelf, identifying issues (like OOS, missing/non-compliant content, or negative reviews) that you will want to take action on.

- Store-based analytics is essential for Food & Bev. According to IRI data, almost two-thirds of online Food & Bev sales were fulfilled via store pickup or local home delivery in 2021. This underscores how important it is for brands to track daily inventory and prices at the retailer store level in order to maximize sales via click & collect and last mile delivery.

- Track online pricing dynamics in this inflationary environment. Use a “hands-on keyboard” approach in order to (1) avoid race-to-the-bottom pricing or (2) leave money on the table by not monitoring competitors’ prices. It’s also smart to understand which of your products are the most / least price sensitive so you can confidently consider price increases. (Watch our webinar Winning against inflation on demand)

- Keyword trend-tracking can provide early demand signals. Regularly monitoring keyword trends (using tools like Amazon keyword search trends or Google Analytics) can facilitate better demand forecasting and help mitigate out-of-stocks. Staying on top of evolving trends and analyzing your Price Pack Architecture can also help identify potential blind spots in your product assortment.

Contact Profitero for a product demo and to learn how we can help your brand become more eComm ready.