Every brand dreams of a product achieving cultural phenomenon status. Enter Labubu, which is taking the world by storm.

For the uninitiated, Labubu are plush toys sold by Pop Mart, a Chinese toy company. They range in size from doll to keychain, with countless varieties available around the central theme of a grinning “monster”.

A major factor in Labubu’s appeal is the use of “blind boxes”, which adds a surprise factor: the buyer never quite knows what they’ll get. The excitement of blind boxes drives virality through UGC, such as “unboxing” videos on TikTok.

There’s been no shortage of toy collectibles over the years, so it’s reasonable to wonder why Labubu has reached escape velocity. The answer is that Labubu is a product in the right place, serving the right audience, at the right time.

What CPGs can learn from Labubu

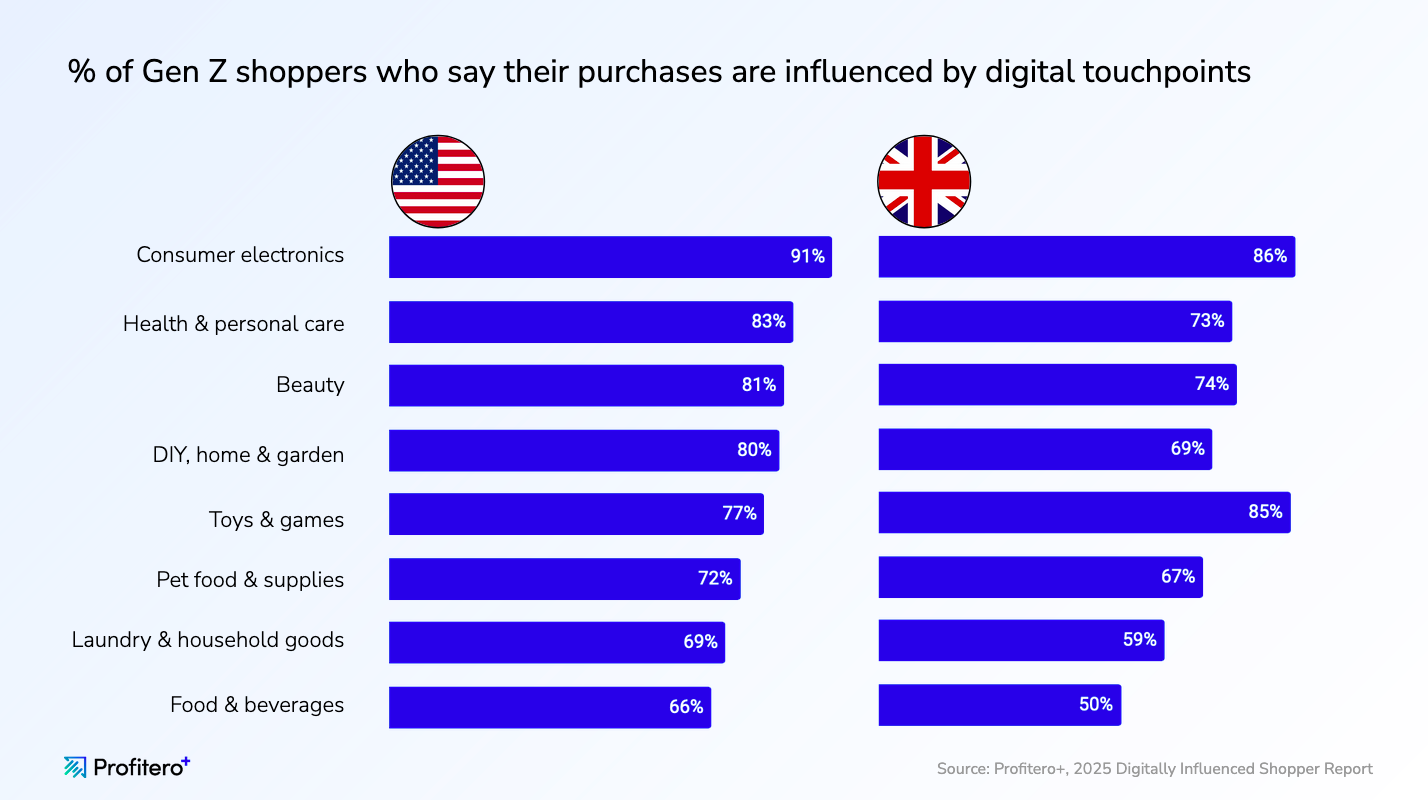

Blind boxes and limited edition collectibles are traditionally associated with toys and apparel, such as LEGO minifigures. But given the rise of digital influence and social media, all verticals can increasingly participate in these trends – especially with Gen Z projected to represent $12 trillion in spending power by 2030.

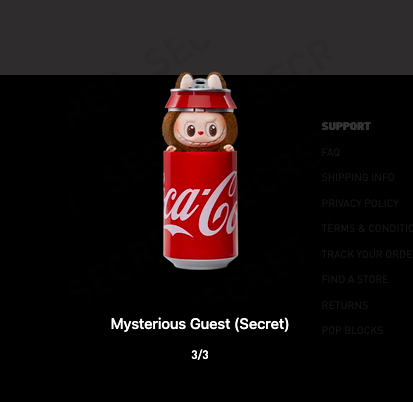

Multinational brands with household recognition can jump aboard through partnerships – as Coca-Cola has done with Labubu:

Beyond collaborations, brands can take it a step further by integrating little treats, surprises and scarcity into their own assortments:

Viral trends move faster than any traditional CPG brick and mortar workflow can keep up with. To maximize the profitability potential of going viral, brands need continuous daily digital shelf monitoring and the right tools to act on it.

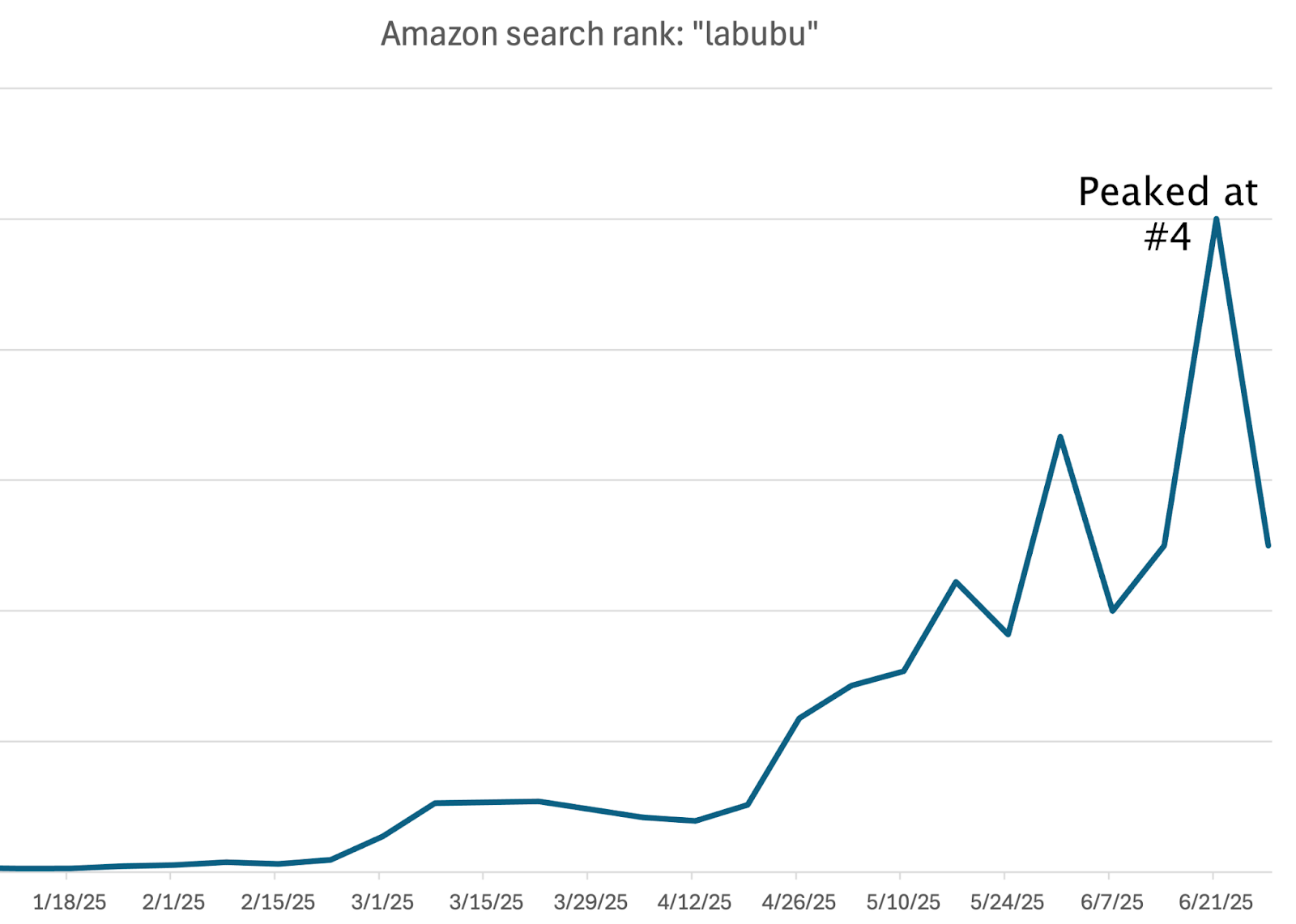

Amazon search rankings closely mirror pop culture trends. “Labubu” recently peaked as the 4th most-searched term on Amazon (despite not being officially sold on Amazon), but searches began going parabolic as early as February. The earlier brands can identify trends and plan their move to jump aboard, the better positioned they’ll be – and selling on Amazon offers a first mover advantage.

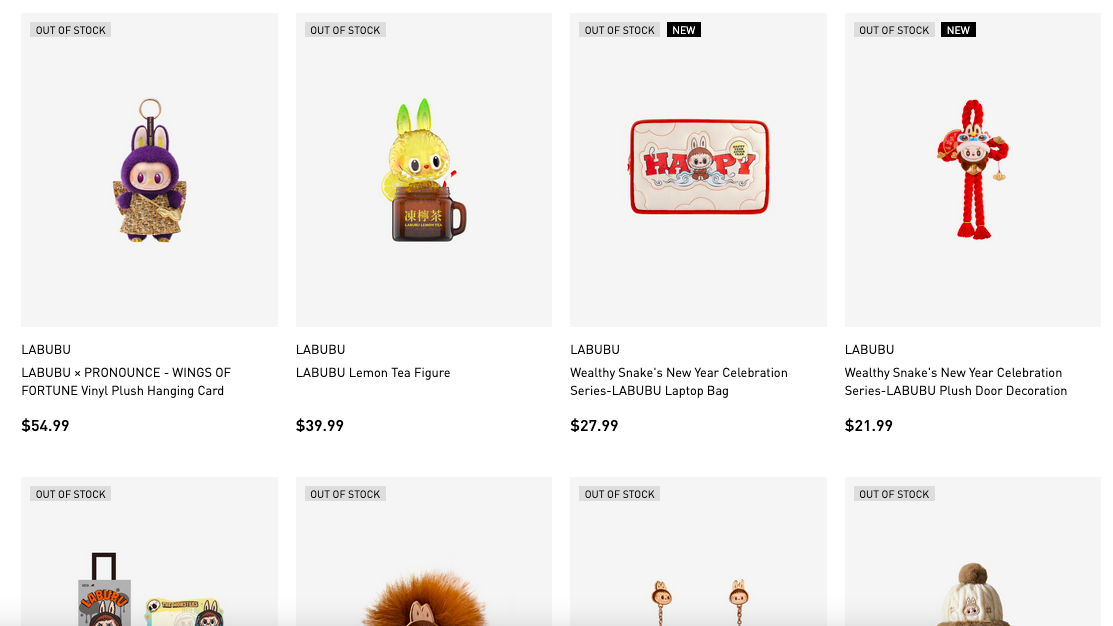

On Pop Mart’s website, the entire first page of “labubu” search results is out of stock. Limited editions, by their nature, can’t always be available – but this must be balanced against lost sales when it’s too difficult for consumers to find something to purchase.

To make the most of a viral moment, brands should monitor availability daily with digital shelf tools such as Profitero+ to get ahead of supply chain crunches and ensure consistent stock. Going out of stock at the wrong time can be costly – Profitero+ research finds that 1 in 3 consumers will switch brands when their first choice is unavailable.

Trends are difficult to anticipate, but brands can monitor social media for leading indicators of a potential surge in orders, such as popular unboxing videos featuring their products.

Agile 3P competitors have a leg up in moving to fill a viral surge in demand. In the case of Labubu, a thriving market has sprung up for “Lafufus”, counterfeit products from 3P sellers. Too much 3P competition can seriously erode a brand’s sales potential at a critical moment.

Amazon Sales & Share by Profitero+ provides highly granular and accurate 3P monitoring to help brands defend their position and retain or regain the Buy Box. We’ve empowered brands such as Goliath Games to cut 3P interference in half and recover six figures in revenue.

Our Autopilot solution takes it one step further. Automated agents monitor PDPs and fight back against unauthorized 3P variants, handling the process from case open to case closed.

Learn more about the end-to-end Amazon solution by Profitero+ here.

Consumers will naturally be drawn to counterfeits when the “real thing” is out of stock, and might not switch back to your brand when given the chance. For this reason, proactive measures are better than reactive ones: consistent availability is the key.

Learn more: how to win with digitally influenced shoppers

Profitero+ recently published our deep dive into digitally influenced shoppers, drawing on our multi-national survey of over 4,000 consumers. Click below to access the full report: