Retailers are locked in an arms race, monitoring each other’s pricing and dynamically repricing.

Profitero’s data reveals that retailers like Amazon are repricing some products daily or even more frequently. In fact, we found that 71% of products sold by 3P sellers on Amazon had intraday price changes — with some prices changing as many as 249X a day! Competing retailers usually aren’t too far behind in matching prices.

Not all price-matching policies are rational or sustainable. Some can be downright destructive to retailer and brand economics. Don’t despair! While pricing is at the sole discretion of the retailer, manufacturers do have the power to influence their products’ pricing.

But first, you can’t take action on what you don’t measure.

So, priority #1: Put a price monitoring solution in place that gives you the needed visibility into pricing dynamics. And don’t just monitor your largest retailers (e.g., Amazon, Walmart.com, etc.). Everyone is discounting and promoting these days. Any retailer — including 3P sellers — can trigger Amazon’s price bots.

Here are 4 important pricing metrics you should routinely monitor to avoid potentially damaging outcomes, including product delisting — and more importantly, actions you can take to help maximize product price and optimize item-level profitability.

1. Watch for Average Selling Price erosion

Average Selling Price (ASP) is the average price at which an item is sold over a given period. Intense price competition tends to erode ASPs. If they’re deflated for too long, retailers and brands risk anchoring shoppers’ perception of price and value to the new, lower prices, impacting brand equity and economics.

What you can do: It’s important to identify and prioritize items with the most significant and sustained drops in ASP. Then take steps to stabilize the situation and work instead to turn things around to maximize ASP. This could mean thinking about promotions in a way that preserves, not destroys ASP or revisiting your price pack architecture (PPA).

2. Keep an eye on First Movers & Followers

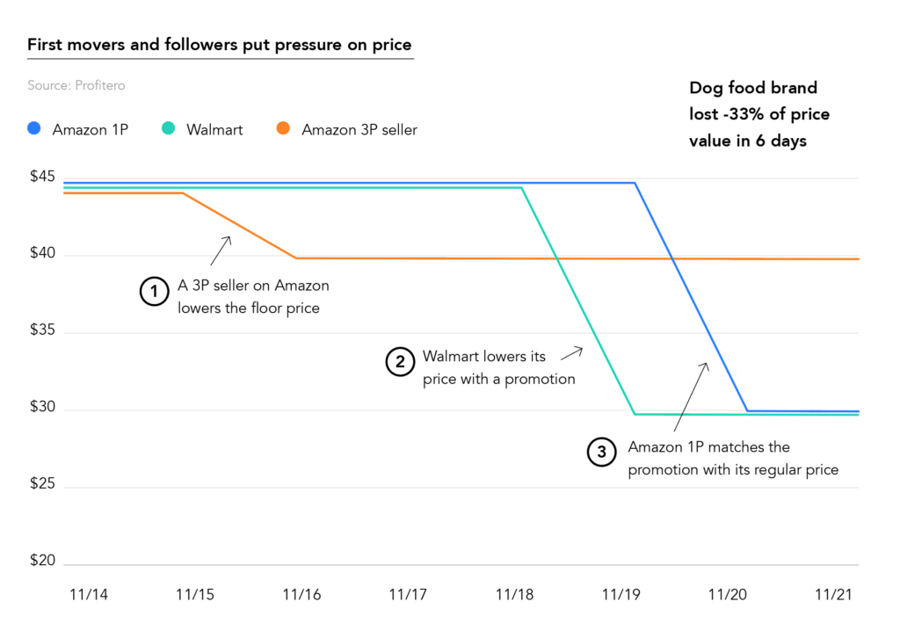

When one retailer in the market drops the price of an item below the “floor price” (the lowest price on that item at that point in time), that retailer is the “First Mover.” Retailers that match the First Mover’s price (or drop their price below the previously established floor price) are “Followers.” So, detecting which retailer or unauthorized seller “fired first” is key to identifying the root cause of unsustainable price competition. Otherwise, it can become a destructive game of follow the leader.

What you can do: Identify weak points in the supply chain and enforce selective distribution, Minimum Advertised Price (MAP) policies or other commercial agreements.

3. Know who’s winning the Buy Box

Keep a close eye on who’s winning the Buy Box because Amazon vendors only get credit with Amazon for first-party (1P) sales. You should be taking action if your products increasingly are losing 1P seller status on Amazon to a 3P vendor.

What you can do: Monitor Buy Box win/loss rate and prioritize the highest-velocity items with the lowest win-rates. Diagnose loss factors like temporary supply issues or price competition, e.g., if 3P sellers have lower prices.

4. Avoid not-so-desirable Amazon designations

Much to their chagrin, some brands’ best-selling products are being abruptly designated as Can’t Realize a Profit — or CRaP — on Amazon. Being labeled CRaP, Exclusively for Prime or an Add-on Item are all designations that limit a product’s availability or eligibility for purchase until Amazon’s economics improve. Consider these tags as red flags — some of the unfortunate consequences when pricing is at the mercy of machines.

What you can do: Assess price competition and Average Selling Price trends to identify opportunities to increase your ASP. It’s definitely a good idea to also assess your pack configuration and supply chain dynamics, looking for opportunities to improve the item’s cost structure.

Download Profitero’s guide Avoiding a Race to the Bottom: How to create a sustainable eCommerce pricing strategy to learn more ways to maximize ASP and ensure economics that work for both you and your retail customers.