Consumers are increasingly aware of the food and fitness choices they make. According to a Nielsen online survey, more than two thirds (67%) of consumers said that they prefer to cook at home to know what’s in their food.

This health-conscious attitude is spilling over into online browsing behavior, with 59% of those surveyed by Nielsen saying that they use the Internet to research nutrition, fitness tips or healthy recipes.

It is also driving interest in, and purchases of, housewares online. Consumers are looking for air fryers, rice cookers and other food prep products on Amazon that fit in with their health-conscious lifestyles.

I recently spoke about popular home and garden search terms, consumer generated content and third-party sellers in a webinar with Nielsen’s Jordan Rost and BzzAgent’s Darcy Reifenberger. In this post, I share several main findings from the webinar on how housewares’ brands can accelerate eCommerce performance.

#1. Focus on search performance: ensure products appear on Page 1 of a retailer’s search results

Profitero has found that products jumping from page 2 to page 1 (on a retailer site) have an average sales lift of 34%. For the top-searched keywords the lift rises to 101%, which means that you double your sales by moving from page 2 to page 1.

According to the State of Amazon 2016 report by BloomReach, 55% of consumers begin their search directly on Amazon when shopping for products online, bypassing Google and other search engines and retailer sites. This raises the stakes for optimizing search on Amazon.

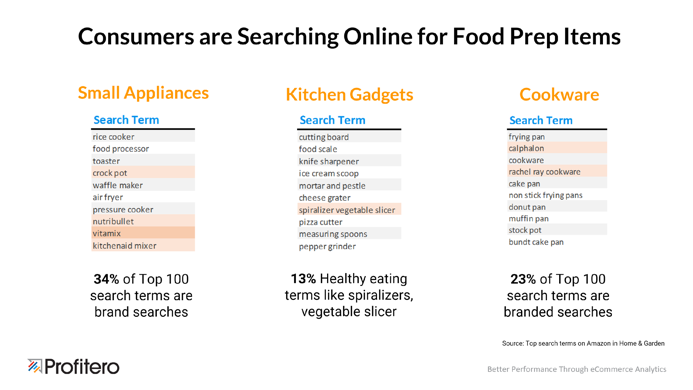

Profitero’s Jorge Castrejon analyzed the top 100 keywords on Amazon in the Home and Garden category, which includes small appliances, cookware and kitchen storage/gadgets. In the small appliances category he found that “rice cooker” ranked among the most frequently searched terms along with “food processor” and “toaster” and others. Branded search terms (those pertaining directly to a specific brand) also figured prominently in consumer searches for small appliances, accounting for 34% of the top 100 search terms.

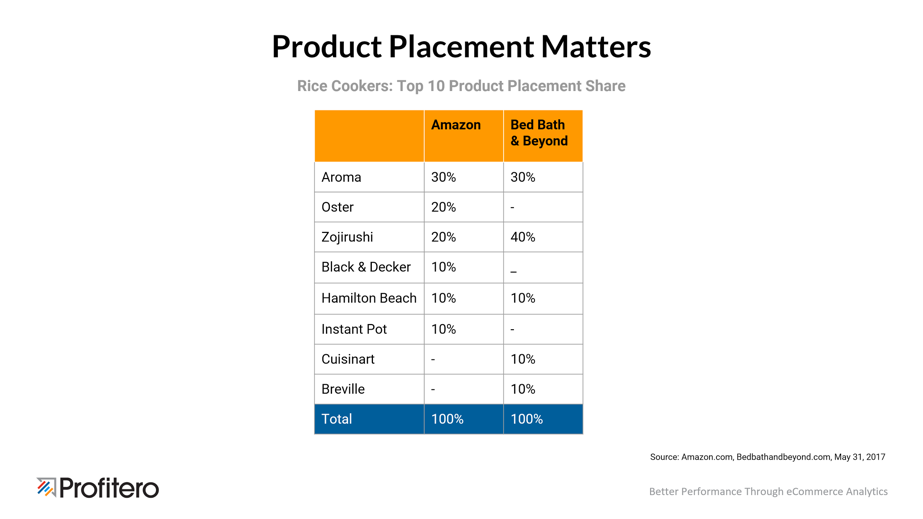

He also analyzed the top 10 products by placement share for the term “rice cooker” on Amazon.com and bedbathandbeyond.com.

Cuisinart, for example, made up 10% of the top 10 products shown on Bed Bath and Beyond for the term “rice cooker” but did not appear in the top 10 on Amazon. It is important to know where products are visible to shoppers and where they are invisible on the digital shelf.

Food prep brands that are winning online are optimizing their product content to drive sales by focusing on search performance and ensuring that their product appears on page one of retailer’s search results.

Even if products have a relatively high share of placement, like Aroma and Zojirushi in the rice cooker example above, what shoppers see next plays a very important role in whether they are actively considered.

#2: Identify gaps in ratings and review content by benchmarking to the category and competitors

Products with a star rating between 4.0 and 4.5 concentrate 56% of Amazon sales and have an average of 197 reviews.

(Download our latest white paper – Assessing the Impact of Ratings and Reviews on eCommerce Performance – for the full analysis).

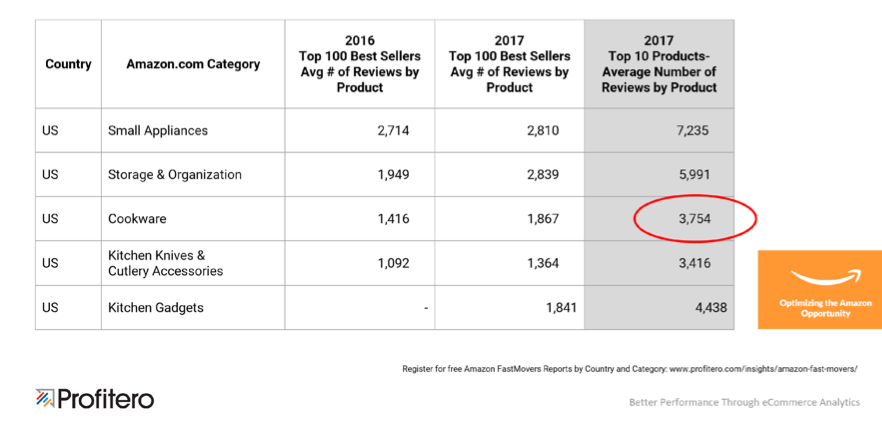

The Top 10 products on Amazon in most categories across the U.S. and U.K. tend to have a larger number of reviews than the Top 100 category average.

In fact, in the housewares categories we analyzed many of the Top 10 products had double or triple the average review count for the Top 100 best sellers.

When it comes to eCommerce performance, understanding the Top 10 and Top 100 sellers is a great start. Advanced eCommerce professionals also benchmark themselves to direct competitors in terms of review count, star ratings, and review “velocity” or “recency” (which is connected to the vintage of your reviews).

#3: Understand how much competition there is on products and diagnose where you are losing the buy box and why

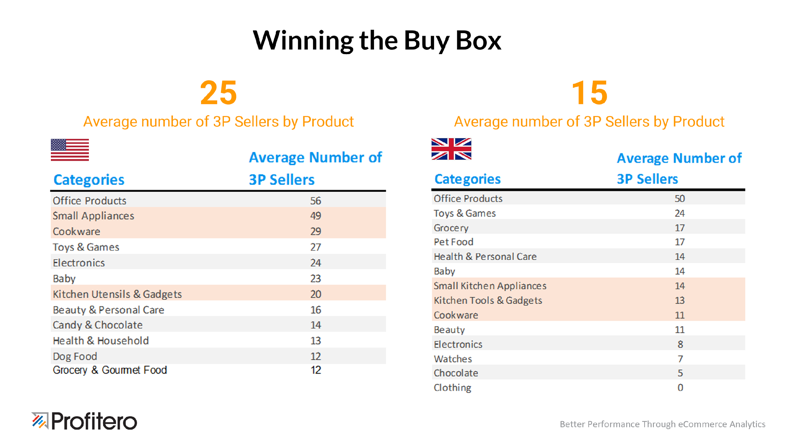

In a Profitero blog archive Ryan Jepson spoke about winning the buy box on Amazon and why it can be helpful to know how many third-party sellers are competing with Amazon for a given SKU. After all, the brand only gets credit when Amazon is the seller of record.

When it comes to housewares we looked at the number of third-party (3P) sellers in small appliances, cookware, and kitchen utensils & gadgets to see just how competitive these categories are. In the United States there is a lot of competition. For example, small appliances in the United States has an average of 49 3P sellers by product, more than 2X that of electronics and 4X versus Grocery & Gourmet Food.

- First, the item may not be available directly from Amazon.

- Second, Amazon may carry the item directly but it may be temporarily out of stock.

- Third, a 3rd party seller may be undercutting Amazon on price.

Profitero’s clients can see when they have issues losing, and if they do, on which items and what the potential causes are so they can shift demand back from third-party sellers.

For more information on how health-conscious consumers are driving demand for food prep/housewares online, watch an on-demand recording of the webinar.