Make no mistake about it: The fast-moving consumer goods (FMCG) and retail landscape is facing systemic change unlike anything in recent history. While the first quarter of the year kicked off with slowed growth, the recipe for selling hasn’t really changed: retailers need to find more customers and get them to load up bigger baskets while raising prices. Yet slowing U.S. population growth, fragmented spending across channels and deflationary pressures remain key challenges.

Consumers have more choice than ever before on where to shop, which is leading to dollars going to fewer and fewer retailers. As of 2016, only 50 retailers accounted for nearly 80% of all FMCG sales, one-third less than a decade ago. This has shifted the balance of power away from brands and retailers and into consumers’ hands. However, while the market isn’t bearing growth overall, the long tail of FMCG companies and brands is still growing healthily. In fact, the smallest companies drove more than half of all FMCG growth over the last few years, while the 10 largest companies have posted relatively flat growth across the board.

So Where Do Manufacturers And Retailers Find Growth?

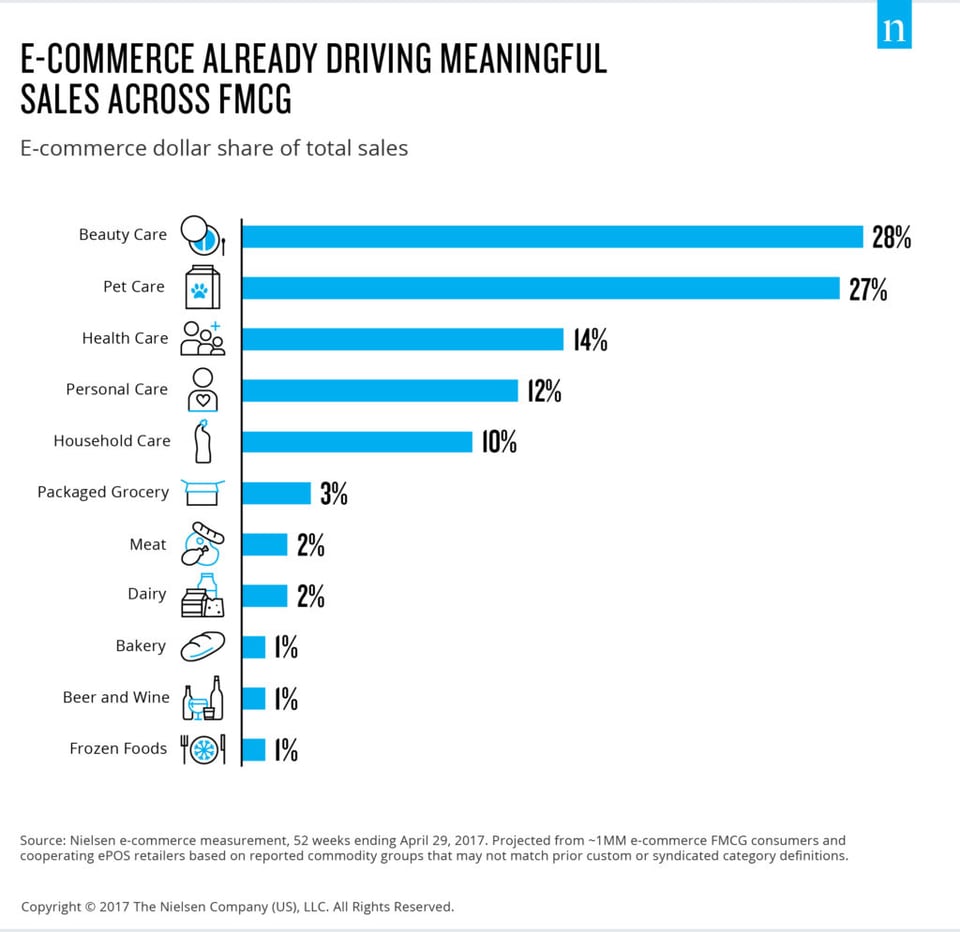

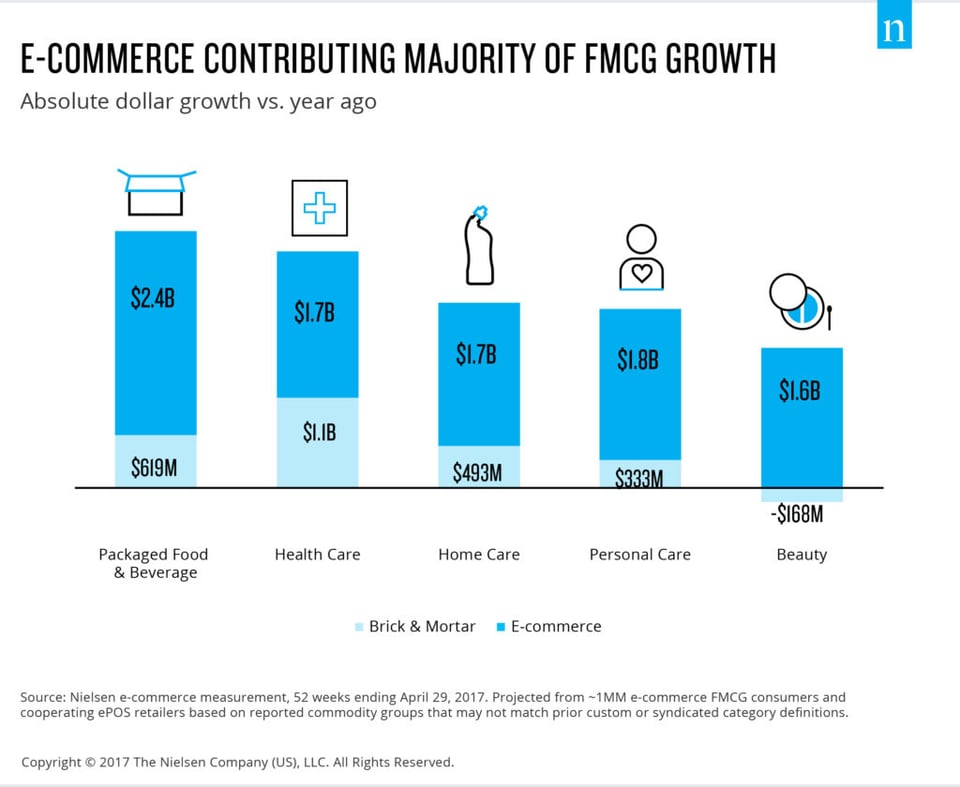

When it comes to online sales of UPC-coded items, it’s still the early days, with nearly 6% of total sales coming from eCommerce channels (not including meal kits and grocery delivery services). However, despite the small single-digit growth of eCommerce in the U.S., there are a handful of categories already driving up to a third of their sales from eCommerce.

When we look not only at share of sales but more specifically, share of growth, eCommerce becomes even more meaningful. In the case of personal care, roughly half of all growth in this category is coming from eCommerce, which represents about 9% of its total sales. eCommerce sales of packaged food represents around 2% of sales but 20% of growth within that department, and 90% of growth across pet care categories.

Fulfilling Online Shoppers’ Preferences

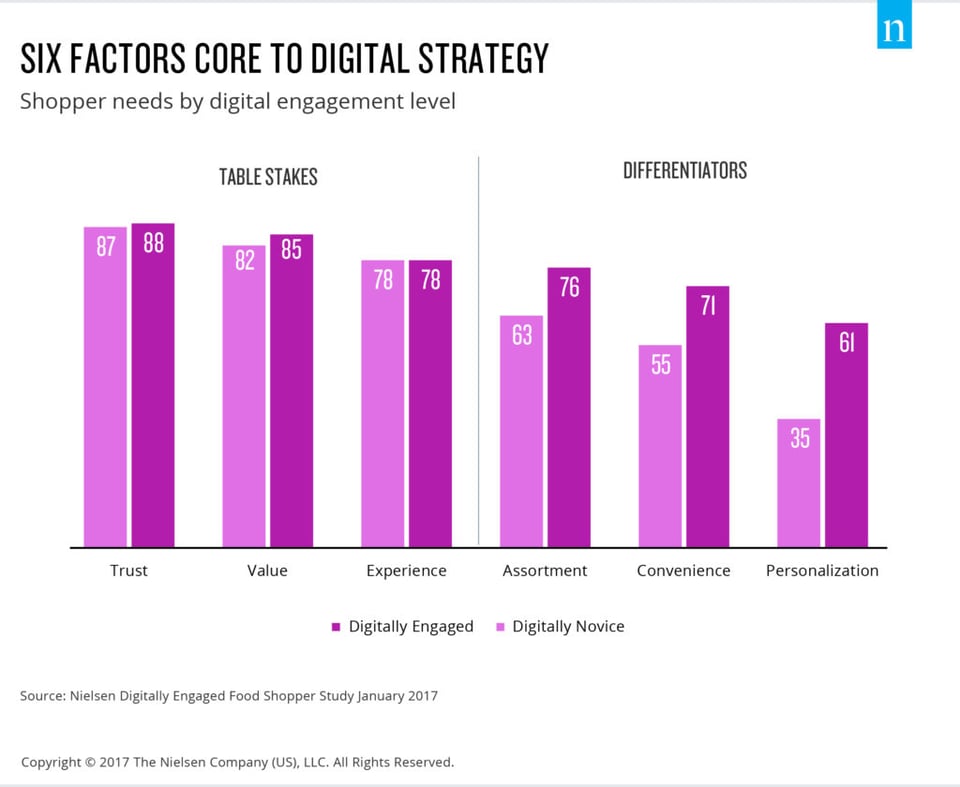

As the grocery-retail landscape continues to incorporate digital, there are six core factors to delivering on consumers’ preferences and needs, whether they are digitally engaged or digital novices.

Trust, value and experience are table stakes for all shoppers. When it comes to trust, online shoppers demand that orders are accurate, delivered on time and that no products arrive damaged. Value is centered on promotions that also offer relevant benefits—and not just the lower price. And when it comes to experience, online shoppers are looking for enjoyable and easy-to-navigate platforms.

Assortment, convenience and personalization top the list of importance for the most digitally engaged shopper. As more and more shoppers become digitally savvy, it’s important that online retailers are focused in these areas as they are likely to be key differentiators over the long term.

Food Spending Is Shifting To Out-Of-Home

According to USDA food expenditure data, consumers are spending increasing food dollars away from the home. In fact, 2016 was the first year that consumers spent more food dollars on restaurant-prepared meals than for meals prepared at home. However, restaurant dining is no longer limited to actually eating at a restaurants. While in-restaurant dining isn’t dead, consumers are increasingly turning to digital platforms and third-party apps to have restaurant meals delivered to their homes.

Meal kits are another example that demonstrate a similar “discovery” appeal that consumers might enjoy from dining out away from home. However, non-retailer food delivery services continue to have a profound impact on the restaurant industry, taking share from in-restaurant dining experiences.

Share shift is happening via out-of-home channels, but similar to the grocery and retail landscape, new digital channels are creating disruption across the board.

Fresh & Deli Prepared Will Lead The Future Of Grocery Retail

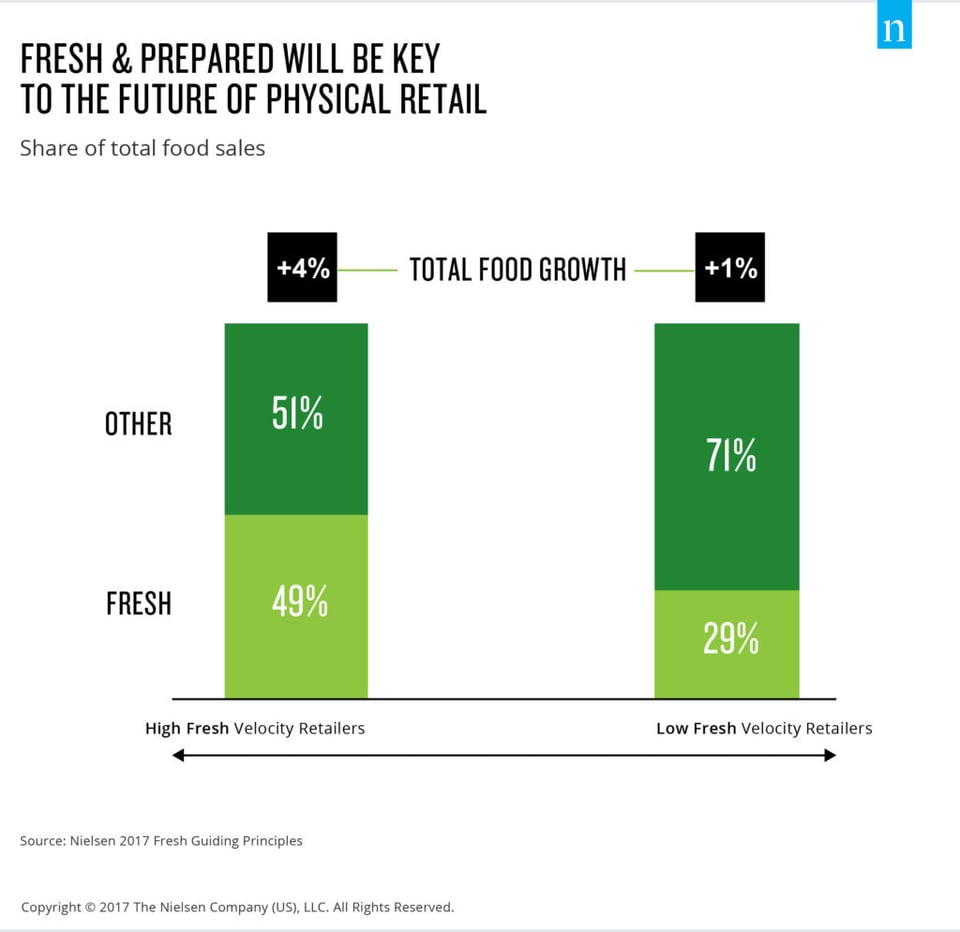

Winning in fresh can lead to total food success, top-performing fresh retailers have top-performing sales across the whole store. For manufacturers, it’s also crucial to understand this in order to support retailers.

But where we truly see the power of the perimeter is when we took a look at growth factors. For top-performing fresh retailers, 50% of their total food sales come from fresh, whereas for low fresh velocity retailers, only 30% of total food sales are from fresh. To emphasize this even more, top-performing fresh retailers’ dollar sales are growing at a rate of 4% across total food, while dollar sales at low-performing retailers in fresh are declining 1% across the total store. And finally, only the top group of fresh velocity retailers saw an increase in trips to their stores.

One crucial factor for online retailers to win in fresh is click and collect. This model, which allows consumers to purchase products online and then pick them up in store, will increasingly bring perimeter-store shoppers online. Although online grocery shopping is growing, consumers still want the experience of selecting their fresh items by hand. And fresh categories are more likely to be included in a click-and-collect purchases when compared to the average eCommerce order, such as fresh meat (223% more likely), produce (180%) and deli (163%).

These figures indicate that leading with a strategy focused on fresh has the power to drive total food success.

For retailers and manufacturers alike, the key to growth is understanding the total view of consumers: changing demographics, how they shop online, what factors influence their online purchases, how they eat away from the home and how fresh will continue to drive total store success.

For a deeper view into the dynamics of today’s retail landscape and how consumers are shopping differently across channels, download Nielsen’s Total Consumer Report.