The Patriots may have won Super Bowl 2017 but which brands won online?

Profitero’s FastMovers reports monitor Amazon’s best sellers lists daily and analyze products’ performance over specific time periods to produce a cumulative ranking of best-selling products.

In the two weeks leading up to Super Bowl 2017 (starting January 23 and ending on February 5 2017), we reported the following activity in the Crisps & Chips and Soft Drinks categories on Amazon.com:

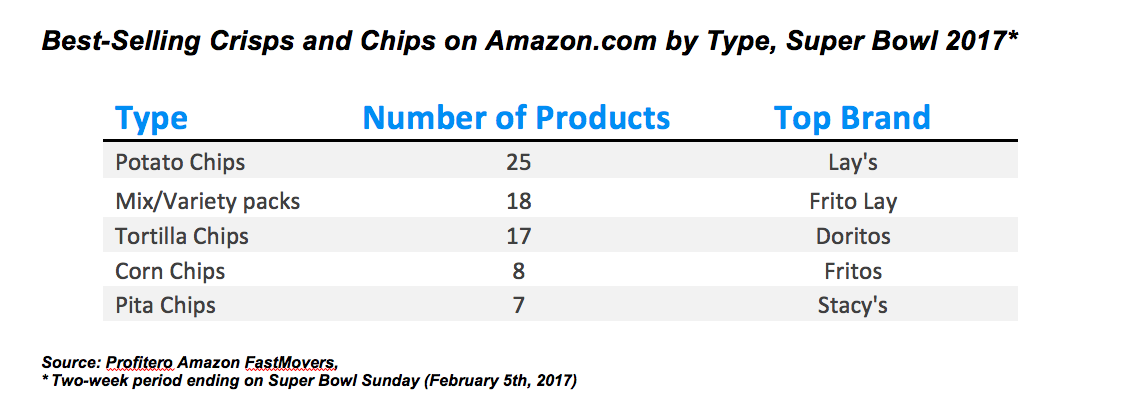

- 24 of Amazon’s top 100 best sellers in the Crisps and Chips category were large packages (+10oz) – with 8 of them explicitly stating ‘Party Size’ in the product title as U.S. consumers planned their Super Bowl parties.

- The average price of these products was $4.29 vs the category average price of $7.42, offering shoppers a “value” option to share with friends and family (The average price is calculated by the sum of the individual average price of products during the two-week period divided by the number of products).

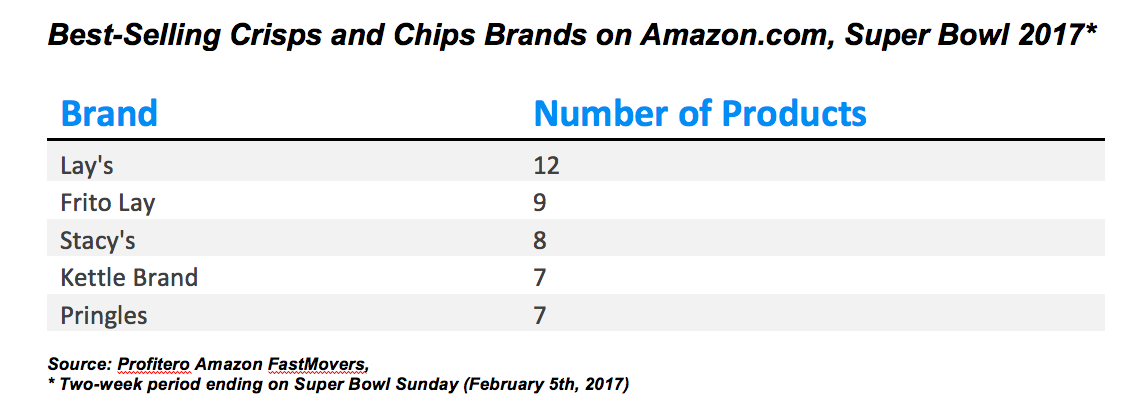

- Lay’s had the highest number of products to feature on Amazon.com’s Top 100 Best Sellers for the Crisps and Chips category during this 2-week period, however U.S. shoppers also embraced alternative options. Brands like Stacy’s and their Pita chips, and Kettle Brand with their natural potatoes, featured highly in the top 100 best-selling brands for the category, with 9 and 8 products respectively.

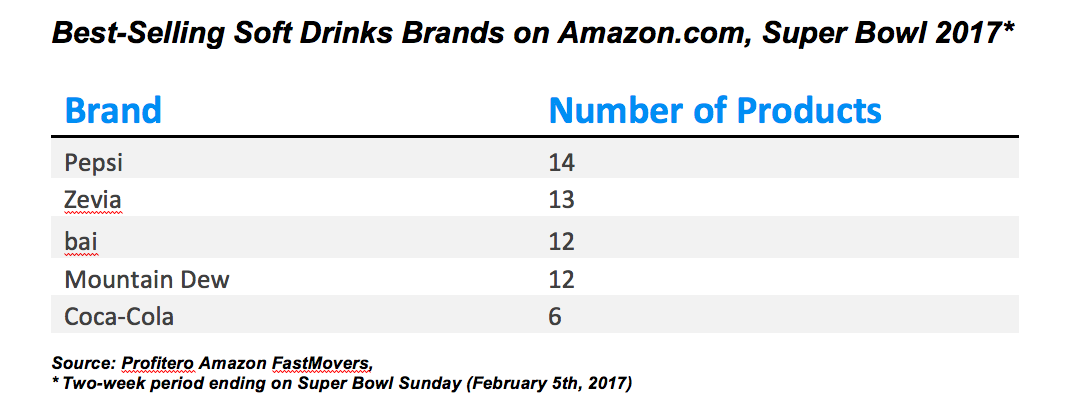

- Super Bowl 2017 was also a good one for soft drinks brand PepsiCo, which hosted the much-anticipated Super Bowl halftime show featuring a performance by Lady Gaga. Pepsi had the highest number of products to feature in Amazon’s Top 100 Best Sellers List for the Soft Drinks category on Amazon.com with 14 products, ranking above Coca-Cola with 6 products.

- While big brands dominated Amazon’s best sellers during Super Bowl 2017, alternative brands also ranked highly. Antioxidants drink Bai accounted for 12 of the best-selling products in Amazon’s Soft Drinks category in the run-up to Super Bowl (Bai also ran a highly acclaimed commercial during this year’s big game to raise the profile of the brand, featuring Justin Timberlake).

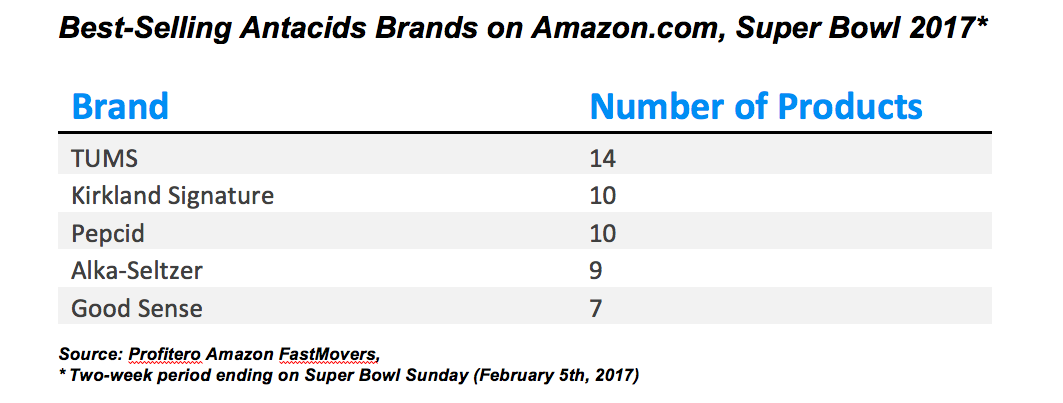

- With Super Bowl Sunday the second biggest day of the year for U.S. food consumption (after Thanksgiving), it’s no surprise that antacid sales were expected to increase by 20% on the Monday after Super Bowl. TUMS was the best-selling antacid brand on Amazon.com in the 2 weeks leading up to Super Bowl.

- Consumers were looking for maximum relief after the Super Bowl feast. In the two weeks leading up to the Super Bowl, 33 of Amazon top 100 sellers were ‘Maximum Strength’ related products. Keywords used by brands in their product titles included ‘Maximum Strength’ (16 mentions), ‘Extra Strength’ (9 mentions), and ‘Ultra Strength’ (8 mentions).

How brands can capitalize on key seasonal events

As with other categories for which prompted or impulse purchases and event-driven seasonal promotions are key, there is an opportunity for brands to leverage periods of peak demand for sustained, incremental volume or share gains.

The unique dynamic at Amazon and other online retailers with “endless aisles” is that items with strong demand that are under-represented in physical stores outperform. Whatever the desirable feature, benefit, or product attribute, niche or on-trend products are simply likelier to be in-stock at Amazon and easier to find at Amazon.

And given how quickly and easily items can be listed and launched at Amazon, it’s a great platform for emerging brands and new products.

During peak demand periods like the run-up to Super Bowl, it’s also essential to stay in stock. Shoppers can’t convert to buyers if an item is temporarily out-of-stock. And Amazon’s algorithm rewards products that are relevant and selling well, while penalizing items that are relevant but don’t sell well—including because they’re out-of-stock.

So, brands that have items that are in demand, with compelling content, and ample available stock, stand to build great momentum.

Subscribe to our free Amazon FastMovers reports to monitor the best-performing brands across key categories on Amazon. You might also be interested in watching our on-demand webinar: 5 Ways to Optimize your eCommerce Performance with Amazon FastMovers