Nielsen’s Global Health and Wellness Report shows that 31% of Generation Z and 29% of Millennials are willing to pay a premium for sustainably sourced ingredients, while the Organic Trade Association reveals that US consumers spent $43 billion on organic products last year. It’s no surprise that 75% of the categories you find on supermarket shelves have products targeting the wellness segment – and the digital shelf is no exception.

Nielsen’s Global Health and Wellness Report shows that 31% of Generation Z and 29% of Millennials are willing to pay a premium for sustainably sourced ingredients, while the Organic Trade Association reveals that US consumers spent $43 billion on organic products last year. It’s no surprise that 75% of the categories you find on supermarket shelves have products targeting the wellness segment – and the digital shelf is no exception.

‘Organic’ and’ ‘Gluten Free’ are the top two product attributes for grocery

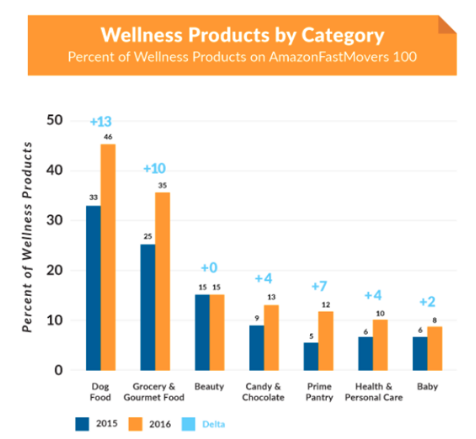

Profitero analyzed the importance of wellness products on Amazon.com’s top 100 best-selling lists in September 2016 across key categories such as beauty, baby, candy & chocolate, grocery, dog food, and health & personal care. Our analysis reveals that more than one-third of the best-selling groceries on Amazon.com (35%) are wellness-related products – up from 25% in September 2015 – with ‘organic’ and ‘gluten free’ the top product attributes.

The dog food category has the highest percentage of healthy products among Amazon.com’s best sellers, with 46% of the products in this category claiming to be natural, grain free and healthy – up from 33% of products in the best sellers ranking in September 2015.

But wellness isn’t limited to food and beverage categories. This fast-growing trend is also prevalent in other categories such as beauty and health & personal care, where the wellness segment accounts for 15% and 10% of products respectively in Amazon.com’s top 100 best sellers.

Which brands are winning in wellness?

While this trend continues to grow, emerging brands have maximized their advantage online, successfully competing with big brand names that typically rule in brick-and-mortar stores. Brands like Kind and Quest Nutrition have positioned themselves as the best-selling brands in the grocery category on Amazon.com, while ArtNaturals ranks highest among Amazon’s best-selling beauty products.

Top Wellness Brands Across Key Categories

Ranked by number of products

| Brand | Category | # of Products | Avg Prod. Rating | Avg # of Reviews | Avg Product Ranking |

| Natural Balance | Dog Food | 9 | 4.5 | 488 | 50 |

| Wellness | Dog Food | 9 | 4.5 | 2,082 | 53 |

| KIND | Grocery & Gourmet Food | 7 | 4.5 | 3,391 | 40 |

| BLUE Wilderness | Dog Food | 5 | 4.6 | 1,048 | 53 |

| Rachael Ray Nutrish | Dog Food | 5 | 4.4 | 1,064 | 51 |

| Cheerios | Grocery & Gourmet Food | 4 | 4.8 | 314 | 31 |

| Quest Nutrition | Grocery & Gourmet Food | 4 | 4.1 | 10,840 | 23 |

| PUR Gum | Candy & Chocolate | 4 | 4.0 | 1,729 | 58 |

| Viva Labs | Grocery & Gourmet Food | 3 | 4.8 | 9,504 | 43 |

| Hill’s Science Diet | Dog Food | 3 | 4.7 | 279 | 68 |

| Radha Beauty | Beauty | 3 | 4.4 | 4,874 | 44 |

| Iams | Dog Food | 3 | 4.7 | 613 | 34 |

| ArtNaturals | Beauty | 3 | 4.2 | 6,902 | 66 |

Sources: Profitero, Amazon FastMovers September 2016

How are emerging food and beverage brands maximizing sales on the digital shelf?

Product content (a product’s images, title and product descriptions) are incredibly important for discoverability – how potential customers actually find a product – and essential for both branded and private label products. Emerging grocery brands like KIND and Viva Labs are optimizing their product content to drive sales online by focusing on search performance – ensuring their product appears on page one of a retailer’s search results. Key to this is understanding which keywords shoppers are using when searching for products (e.g organic or gluten free) and incorporating these keywords into product titles and descriptions. Equally important is customer advocacy: shoppers increasingly trust their peers for guidance on what to buy, and ratings and reviews on eCommerce retailers’ product pages are a source of growing influence.

To conclude

A new generation of shoppers have ended the paradigm of demanding well-established brands and instead, are more focused on the product attributes that align with their lifestyle. Understanding and being able to meet these consumer needs will be a key factor in the growing trend towards wellness products online – and for brands to win the digital shelf.

Check out the top wellness brands on Amazon.com in our recent infographic, or download our Best-Selling Wellness Brands report on Amazon US and Amazon UK.