With each passing year, it seems the holiday shopping season creeps up earlier and earlier. This year is no exception.

But in an interesting twist, many U.S. consumers intend to hold out on spending big online until later in the season. A clear indication that shoppers plan to splurge on Black Friday/Cyber Monday and bide their time waiting for other last-minute deals.

Profitero surveyed 1,000 U.S. consumers in September 2019 to get a read on this year’s holiday shopping plans online. Here’s what we found, and what it means for brands as they plan for and tweak their online strategies.

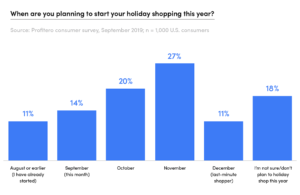

Holiday shopping starts early

Nearly half (45%) of U.S. consumers plan to start their holiday shopping before November hits; 25% have already started (as of September). Still a good portion intend to wait to shop closer to the holidays: 27% say they’ll start in November; 11% will hold out until December.

Note: Another 18% of shoppers are up for grabs, either not sure when they’ll shop or not planning to do holiday shopping at all this year.

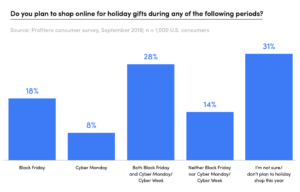

Waiting till Cyber Five or later to spend big online

When it comes to spending online for the holidays though, many shoppers seem content going down to the wire, waiting for the highly promotional Cyber Five weekend (which starts on Thanksgiving and goes through Cyber Monday) or later to get last-minute deals.

Our survey reveals that 57% of U.S. consumers plan to spend the most on online holiday shopping during November and December.

The biggest spending push will be during Cyber Five weekend: 54% of those surveyed intend to shop online on Black Friday, Cyber Monday, or some combination during the holiday shopping weekend.

Still, the potential exists for a lot more, given that another 31% of shoppers are still undecided whether they’ll shop online during Cyber Five. So brands best be prepared.

Profitero analysis from Cyber Five 2018 reveals that while investing in promotions on Black Friday and Cyber Monday may be optimal because traffic and shopper demand spikes highest on these days, it may actually be smart to focus deals on the down days between Black Friday and Cyber Monday this year, when there’s less competition for keywords.

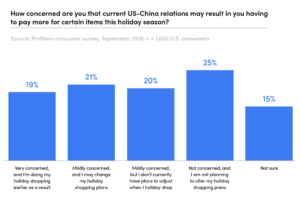

Caution: Potential impact of trade war / tariffs ahead

Uncertainty abounds on how U.S./China relations and rising tariffs will impact prices for certain key categories, like Toys and Electronics, this holiday season. As of September (our survey timing), consumers still seemed slightly lukewarm about any change in their holiday shopping and spending intentions related to the ongoing trade/tariff issues.

Overall, 60% of U.S. shoppers were very or mildly concerned that U.S./China relations could result in them having to pay more for goods this holiday. Still, only 19% said that they were very concerned and planned on doing their holiday shopping early as a result. Another 21% indicated that they may change their holiday shopping plans; 15% were not sure. 45% don’t plan to alter their holiday shopping plans at all.

It remains to be seen who will absorb any costs stemming from increased tariffs: retailers themselves (doubtful), brands (a likely possibility), or consumers (will tariffs be passed through in the form of price increases?). A recent report reveals that Amazon third-party vendors have blamed U.S. tariffs on Chinese goods for increasing their costs, forcing them to slash their margins and push up prices.

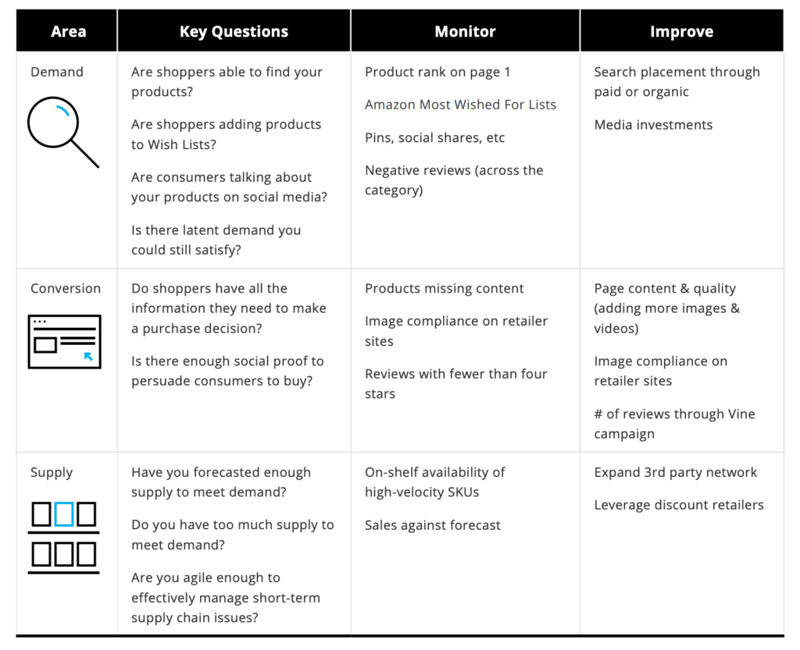

How brands can prepare for a last-minute surge in online shopping

- Accurately forecast and allocate inventory. One of the most important courses of action for brands is to forecast online demand and allocate inventory as accurately as possible. Otherwise, you can run into problems, with huge implications for volume and profitability once the season begins — and as last-minute online shopping becomes reality.

- Stay in stock. Staying in stock is equally a big deal. If you’re out of stock, your item will lose search position on the digital shelf (if it appears at all), which hurts your sales and, in turn, further drops your search rankings. So carefully monitor inventory performance throughout the holiday season and be prepared with stop-gap solutions before they happen (or at least respond quickly to issues if they do happen).

- Monitor performance in near real-time. To ensure you don’t miss a beat during the holidays, digital shelf solution, like Profitero, can deliver alerts on a daily basis to make you aware of execution-oriented “misses” like incorrect product content, a drop in search position or out-of-stocks. This kind of real-time digital shelf intelligence could be a life-saver during the holiday season to avoid missing out on sales.

Request your demo today.

Check out more tips below on what you should be doing to monitor and improve your eCommerce performance this holiday season.