BOSTON & DUBLIN – June 25, 2019. Prime Day 2019 is shaping up to be the most lucrative shopping event yet for Amazon and brands, according to a new study from Profitero 2019 Prime Day Predictions: Look back, look ahead.

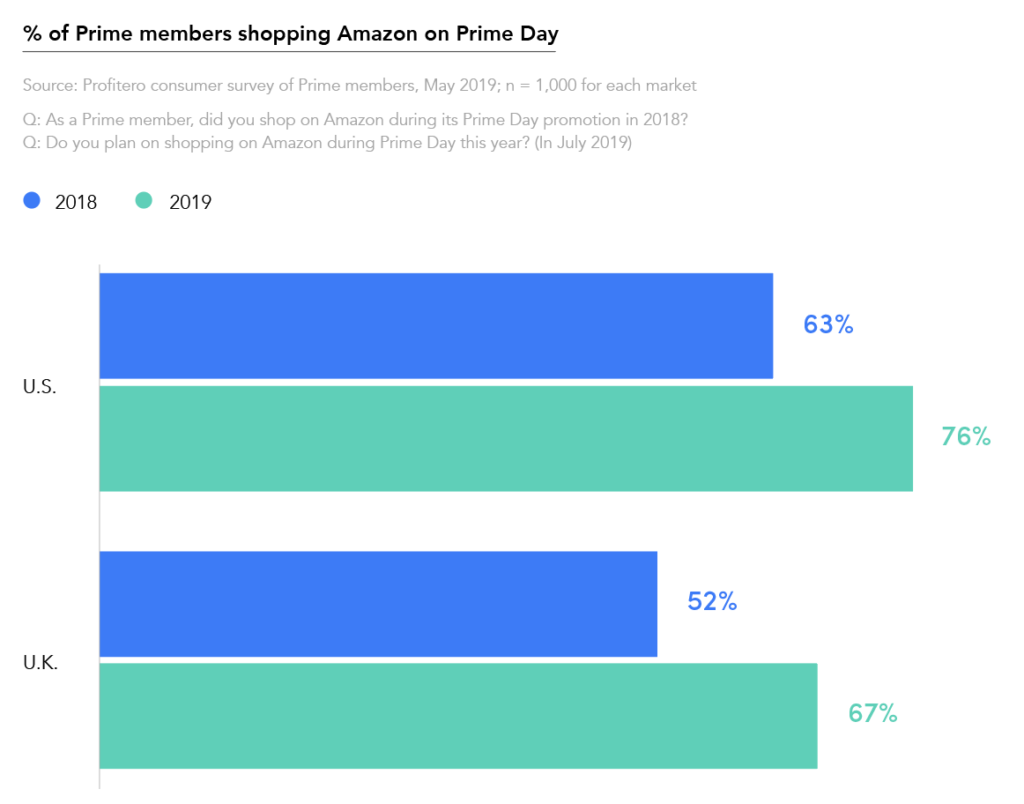

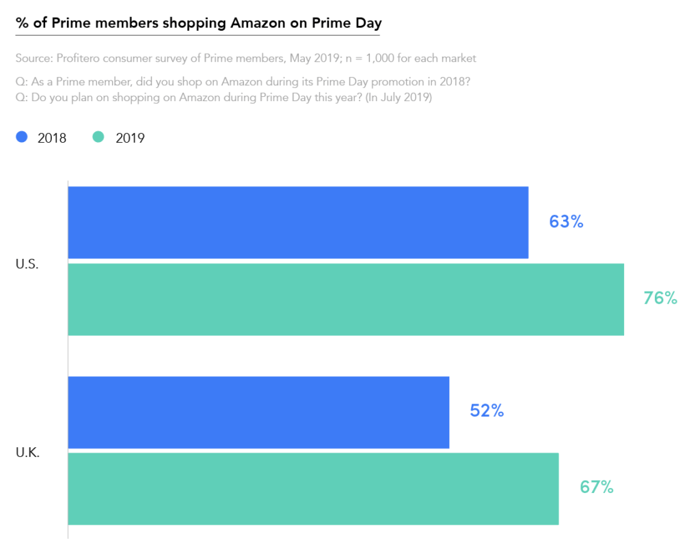

Profitero surveyed 1,000 Prime members each in the U.S. and U.K. in May 2019 and found that Prime Day is only gaining more steam with each passing year. 76% of Prime members in the U.S. are planning to shop on Prime Day this year, up from 63% last year. Global interest in the event is increasing too: 67% of U.K. Prime members plan to shop during this year’s event, up from 52% in 2018.

Across the globe, Prime members agree that Prime Day deals offer strong value, with 62% of U.S. and half of U.K. Prime members expecting Prime Day deals to live up to the hype. More than half of Prime members who purchased last Prime Day (56% U.S., 53% U.K.) expect to spend more this year.

Additionally, the study revealed:

- Retailers beyond Amazon will clean up on Prime Day. Nearly all Prime members who plan to shop on Prime Day will do so on Amazon (98% U.S., 93% U.K.), but more than a third (34% U.S., 38% U.K.) also intend to shop for deals at other online retailers. In fact, more than half of Prime members (58% U.S., 59% U.K.) compare prices on other sites first before buying a Prime Day deal on Amazon.

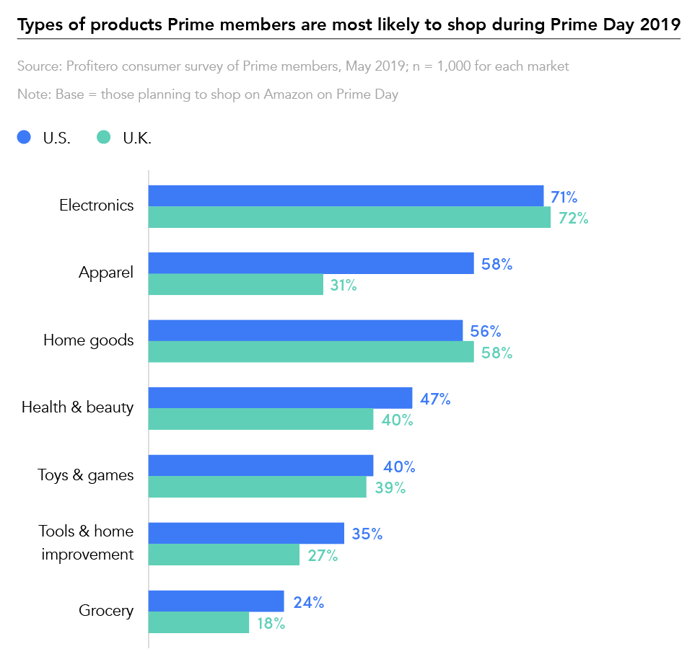

- Electronics will be a best-seller again this year, but clothing and home goods will also benefit. Of those Prime members intending to shop on Prime Day, nearly three quarters plan to shop the electronics category (71% U.S., 72% U.K.); 58% of U.S. members (31% U.K.) plan to buy clothing; and 56% of U.S. members (58% U.K.) plan to shop home goods.

- Online grocery shopping will take off this year. Grocery brands should see a strong sales spike, with nearly one in four U.S (24%) and one in five U.K. (18%) Prime members shopping on Prime Day planning to make a grocery purchase on Amazon.

- Prime Day promotions will drive brand exposure with consumers. Half of Prime members surveyed (56% U.S., 50% U.K.) are likely to try a product they don’t normally buy if offered a Prime Day discount. In addition, about half of Prime members (55% U.S., 46% U.K.) say they usually make an unplanned purchase on Prime Day.

“For brands, Prime Day is the gift that keeps giving, with benefits lasting well beyond the few short days of the actual event. In fact, 66% of products that saw a traffic spike on Prime Day last year benefited from an ongoing traffic lift lasting at least two weeks after the event,” said Vol Pigrukh, CEO and co-founder of Profitero. “With this year’s event expected to attract more shoppers than ever, brands must have their promotions, advertising campaigns, product content and inventory fully optimized in order to maximize sales on Amazon and other retailer sites.”

Click here to download the full study.

About Profitero

Profitero is the eCommerce performance analytics platform of choice for leading brands around the world. With Profitero, brands can measure their digital shelf performance across 8,000+ retailer sites and mobile apps in 50 countries, gaining actionable insights to improve product content, search placement, ratings & reviews, availability, assortment and pricing. Profitero also allows brands to measure their Amazon sales, share, traffic and conversion, and connect it to their digital shelf performance so they can precisely identify the factors influencing desired outcomes. Many of the world’s leading brand manufacturers depend on Profitero’s granular and highly accurate data to measure and improve their eCommerce performance. These include Bayer, Beiersdorf, Dorel Juvenile, Edgewell, General Mills, Kids II, L’Oreal, The Master Lock Company and Molson Coors.