BOSTON, 30 October 2017. A new study from global eCommerce analytics firm Profitero confirms that Amazon may be the current online price leader, but that lead may be slipping as Walmart intensifies its efforts to be price competitive.

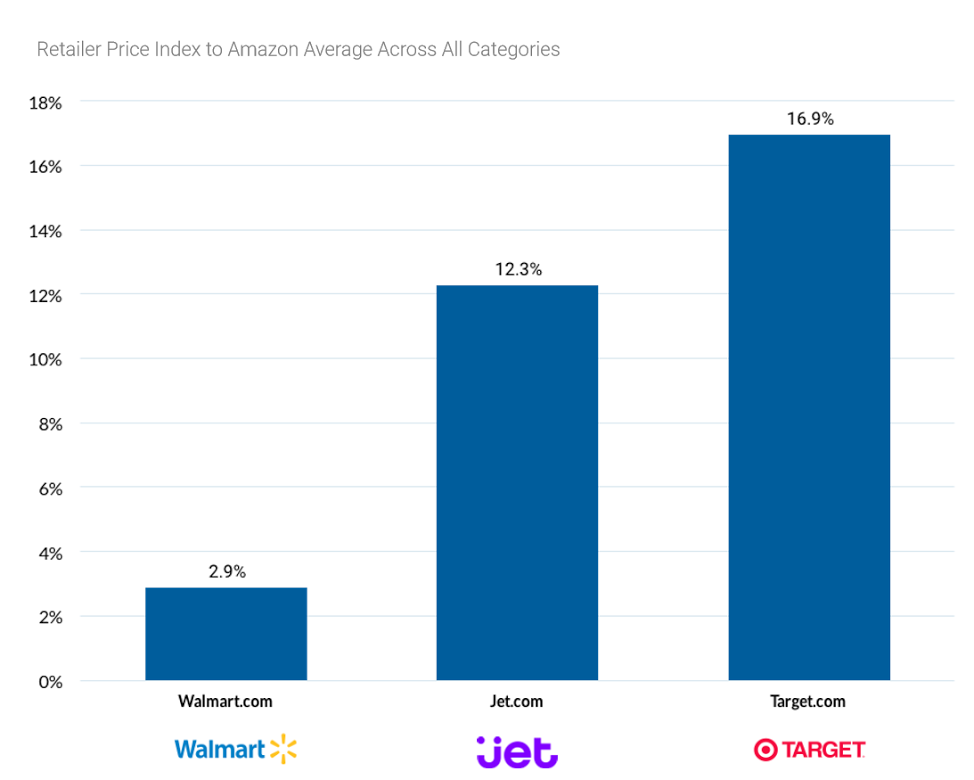

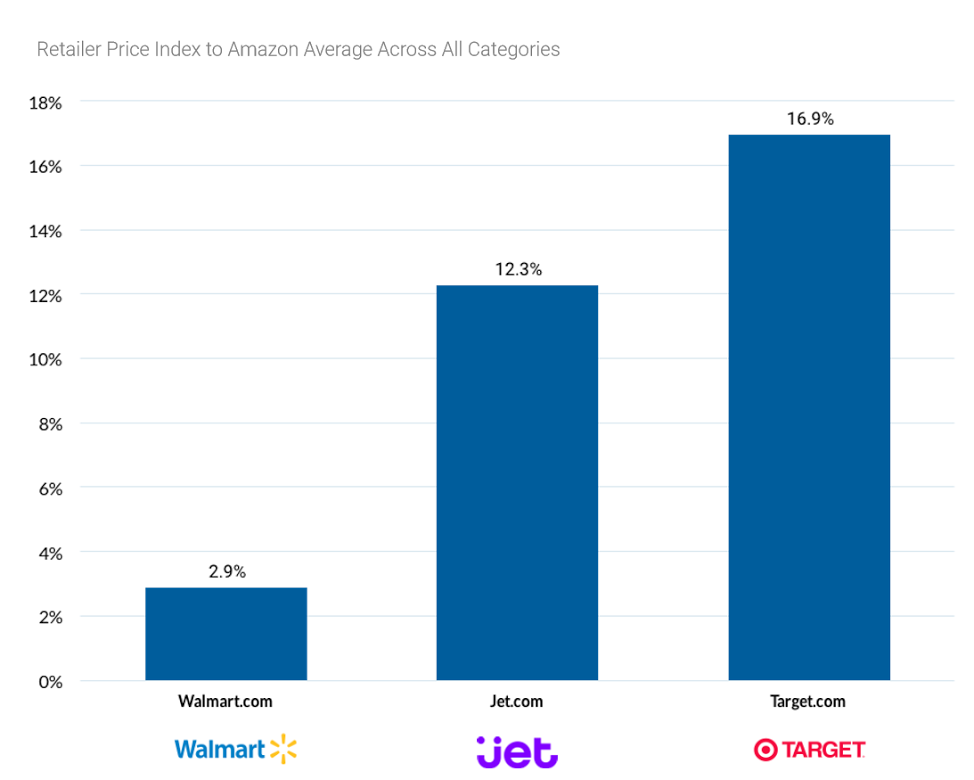

The report, Price Wars: A Study of Online Price Competitiveness, reveals that Amazon’s prices are typically 11% lower than Walmart, Target and Jet. However, Walmart is rapidly closing the gap, with the retailer’s prices found to be only 3% more expensive on average than Amazon across all categories studied. This compares to a 2014 Profitero study which found Walmart’s pricing to be 9% higher than Amazon on average. Target was found to be 17% higher than Amazon on average, and Jet 12% higher.

Source: Profitero

For the study, Profitero analyzed the prices of more than 52,000 exactly matched, in-stock products across 13 categories including beauty, toys & games, electronics and pet supplies, at Amazon.com, Walmart.com, Target.com, Jet.com and specialty retailers, with data collected daily and averaged between June and August 2017 for comparison.

Other key findings from the report:

- Walmart appears to be making the largest strides to compete with Amazon in the beauty category, with products found to be 1% lower than Amazon on average; in the Profitero 2014 study, beauty products were priced 10% higher than Amazon;

- Electronics is one of Walmart’s least competitive categories to Amazon, with products priced 7% higher on average than Amazon;

- Target was found to be the most expensive of the major retailers, and 17% more expensive than Amazon; this marks a shift in price competitiveness from the 2014 Profitero study which found Target pricing to be 10% more expensive on average;

- Specialist retailers such as Staples, Best Buy and Home Depot struggle to compete with Amazon on price: Staples was found to be the most expensive specialist retailer to Amazon (products were 49% higher than Amazon on average), while Chewy.com had the closest pricing (its average prices were just 7% higher than Amazon).

“This year there’s been a marked rise in discussion about an online price war,” explains the report’s author, Profitero SVP of strategy & insights Keith Anderson. “In our biggest ever study, we’ve set out to illuminate the pricing dynamic at play and to better understand the high-stakes race to the bottom we’re currently witnessing between Walmart.com and Amazon.com. While Amazon remains the online price leader, it’s clear that Walmart is on the offensive, with prices just 3% more expensive than Amazon – a significant change from our 2014 study when prices were shown to be 9% more expensive than Amazon. While lower prices are good news for shoppers, suppliers and retailers will inevitably feel the pressure as we head into peak holiday season, as this price war is only set to intensify.”

The full report, Price Wars: A Study of Online Competitiveness, can be downloaded here.

Methodology Summary

Profitero analyzed daily prices collected from June 1, 2017 to August 31, 2017 at Amazon.com, Target.com, Walmart.com and Jet.com across 13 categories. 52,450 Amazon products were monitored and matched across these retailers. Categories monitored were Beauty, Vitamins and Supplements, Video Games, Toys & Games, Tools and Home Improvement, Sports and Outdoors, Office Electronics and Supplies, Music/CDs, Furniture, Electronics, Baby, Appliances and Pet Supplies. In select categories more “specialist” retailers were monitored including Bestbuy.com, Toysrus.com, Homedepot.com and Chewy.com. The study only compares prices collected on the same day, with both retailers in-stock. Products were initially collected from Amazon’s taxonomy, with a focus on best-selling items.