Profitero's Price Wars study compares price difference across German online retailers

Report findings include:

-

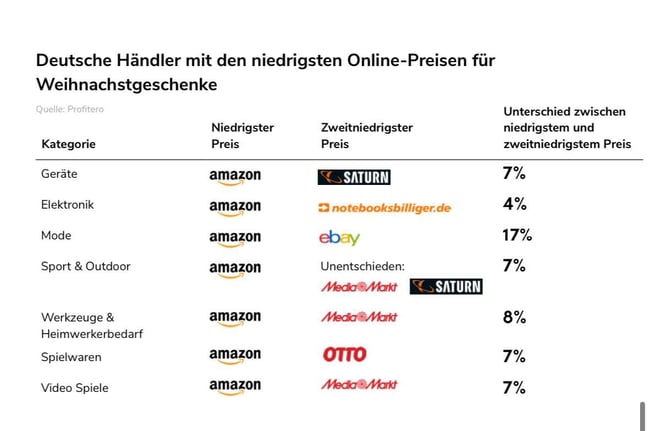

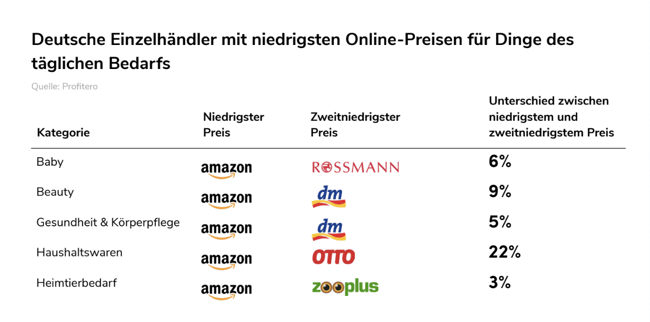

Amazon is on average 15% cheaper than its online competitors and offers the lowest prices in each of the 15 product categories analyzed.

-

eBay, Amazon's toughest price competitor in the fashion segment, is 17% more expensive than Amazon. The full-range grocery retailer Kaufland performed worst with prices 30% higher than Amazon, on average.

-

Saturn and Media Markt are in close price competition with the US online retailer across many categories. Zooplus and Amazon are in close competition in the pet supplies sector.

-

Almost a third of German shoppers consult a retailer's app or website before making a purchase in-store, underscoring the importance of being price competitive online.

With the Christmas shopping season now upon us, commerce analytics platform Profitero has released its second Price Wars study examining price competition across the German landscape. The study compares the daily online prices of more than 11,830 items in 15 categories at 12 leading online retailers, including Amazon, DM, Otto, Media Markt and Rossmann.

U.S. online retailer Amazon emerged as the online price leader, maintaining its position as the lowest cost online retailer across all product categories this year, boasting an average price advantage of 15% over the competition. The most notable savings were found in fashion and household goods, with Amazon outpacing its closest competitor eBay by 17% in the fashion category and undercutting Otto by 22% in household goods.

Major retailers Kaufland and Otto faced significant challenges in matching Amazon's low prices. Kaufland's prices were, on average, 30% higher than Amazon across the compared product categories, reaching a price premium of 49% in the baby category. Otto struggled as well, with double-digit price gaps in 13 out of 15 categories compared.

However, some online retailers stayed competitive with Amazon. With the exception of two categories (health & personal care and office electronics), Saturn and Media Markt were priced only slightly higher than Amazon. Notebooksbillinger was only 4% more expensive for electronics and DM was only 5% more expensive for health & personal care. Online pet supplies retailer Zooplus kept competition close with Amazon with prices only 3% more expensive on average.

Changing digital shopping habits are intensifying price competition among retailers. According to another Profitero study from July 2023, three in 10 Germans regularly consult a retailer's website or app before shopping in-store, with price being the most important comparison criterion. One in four respondents consult a retailer's app or mobile website while shopping in-store, and a third visit a competitor's website or app while shopping.

As Mike Black, Profitero’s CMO explains: "While it’s true that inflation is less of an issue than it was last year, price is still a top of mind concern for German shoppers heading into the holidays. With so many online platforms out there, it’s never been easier to compare prices and many more shoppers are willing to buy products online if they find them more expensive in store. Retailers who can’t compete with Amazon on price must entice shoppers in other ways, such as by offering a unique assortment, more convenience or better service.”

The complete study, Price Wars 2023 Deutschland-Ausgabe, can be found here.

For the German translation of this press release, go here.

Notes to Editors

Only identical items that were available and in stock in the same pack configuration were compared. Data was collected daily over a 12-week period (July 10 - October 1, 2023), with daily prices averaged over the entire period for comparison. Prices for the same items were collected within 24 hours to ensure the validity of the comparisons. Previous Profitero Price Wars studies can be found at: www.profitero.com/insights.

The retailers included in the study are: Amazon, DM, eBay, Kaufland, Media Markt, MyToys, Notebooksbilliger, Otto, Rossmann, Saturn, Zalando and Zooplus.

About Profitero

Profitero is the leading global commerce acceleration company offering a flexible suite of intelligence-driven solutions so that brands can grow profitably. Their integrated digital shelf analytics, shelf-intelligent activation and advisory services empower brands to optimise product availability, discoverability, and maximise conversions across 1,200+ retailers and 70 countries. www.profitero.com