Here are snippets from Profitero’s recent press coverage. See how our eCommerce analytics and expertise are helping brands spot the biggest trends happening across the digital landscape.

Private label products are winning online search

Excerpted from Retail Dive

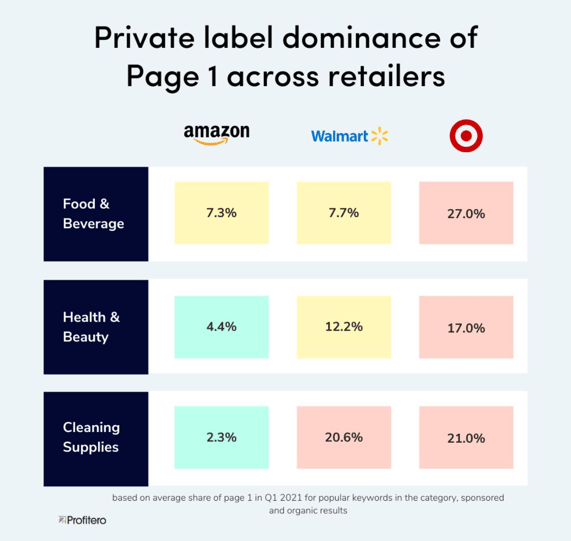

Private labels have increasingly taken up space on both Target and Walmart shelves during the pandemic, and now, a report from Profitero shared with Retail Dive indicates that they're taking up space on the first page and top five slots of retailer search results too.

Target has the highest share of private labels in page one search results, with Walmart and Amazon holding less share. Target's private label food and beverage products occupy close to a third (27%) of organic and paid page one search results, while that number changes to 21% for cleaning supplies, and 17% for health and beauty.

Target's private label options in those categories also hold the largest share in organic search results, each comprising more than a third of the top five organic search results. Meanwhile, Walmart's private label health and beauty, and cleaning supply products make up 20.6% and 25.2% of the top five organic search results, respectively.

Excerpted from Modern Retail

Private-label products are dominating search results on Amazon and other marketplaces. [...] According to data that the e-commerce insights platform Profitero shared with me, Amazon’s private-label products appear in about 9.6% of the first five results across several categories (specifically food & drink, health & beauty and cleaning supplies), whereas Walmart’s take up about 18.7% of those top five results. Target’s private label has the highest concentration, at 37% (although Target is slightly different given that its pool of third-party sellers is so small).

“What’s really surprising to me is just how much some private-label [brands] are dominating page one,” said Mike Black, CMO of Profitero. Under the search term “ground coffee,” for instance, the top results — after sponsored slots — is a slider of five Amazon-owned coffee brands, which appear before Starbucks and Dunkin. The top results are so important in the e-commerce context, Black said, given the power of the first page of search results: Amazon has said that 70% of its customers don’t click past the first page, which means that the vast majority of customers will only ever see a handful of the most highly ranked products.

Building the case for Direct-to-Consumer (DTC)

Excerpted from Path to Purchase IQ

Keith Anderson, Profitero senior vice president, strategy & partnerships, suggests that depth of consumer engagement is one reason that big CPGs are looking to buy DTC brands. “Part of what you’re buying ... is innovation that emerged from somebody who was paying better attention to certain consumers,” he says.

The number of DTC businesses has surged in the past decade because of the increase in digital shopping platforms like Shopify and targeted advertising that makes it easier to reach shoppers, Anderson says. According to him, the new growth model for DTC brands is: “Launch one to maybe three products in a category ripe for disruption, really focus on the quality of those products, set up a beautiful DTC site, and then use Instagram, Pinterest, increasingly TikTok, and some of the other emerging visual social media platforms to reach the audience that you want to reach, and they can buy these individual items almost as seamlessly as Amazon’s one-click model.”

Pandemic spending ups & downs

Excerpted from Adweek

[On the uptick in Pet spending...] According to new data from eCommerce analytics platform Profitero, consumers have been shelling out considerably more on their pets. In 2020, online sales for pet food on Amazon increased by 46% year over year. The two-year trend is even more dramatic, with sales up 67% in the first quarter of 2021 compared to Q1 2019.

As for other pet supplies (like leashes and scratching posts), online sales went up 54% in 2020 and a whopping 102% in the first quarter of 2021, compared to Q1 2019. “With so many adopting a first pet or adding another to their household, pet brands now have a unique opportunity to lean in and meet the needs of these new customers to secure repeat purchases and strong loyalty for years to come,” said Sarah Hofstetter, president at Profitero.

Excerpted from Adweek

[On the Health & Fitness spending slowdown…] Demand for health and fitness products soared during the first year of the pandemic, according to ecommerce analytics platform Profitero. But while some health and fitness categories remain elevated, others have tapered off.

Online bike sales, for example, doubled year over year from 2019 to 2020, with the biggest quarters being Q1 and Q2 2020. Though 2020 ended in an impressive $550 million in bike sales, they did cool off later in the year. The search keyword popularity for health and fitness products like weights, yoga mats, resistance bands and other fitness products followed a similar path.

However, general health categories, such as vitamins, have kept on going strong with no signs of stopping, with a 60% increase year over year (2019 vs. 2020) and a whopping 84% increase from 2019 to 2021. The reason is pretty straightforward: “There’s only so much fitness equipment one household will buy, but vitamins are repeatable purchases that become an easy online reordering habit,” explained Sarah Hofstetter, president at Profitero.

Visit Profitero's Press page for more.