Walmart has released its newly unified eCommerce site, merging the Walmart.com and OPD (local pickup & delivery) experience. The updated site is rolling out in phases, and is expected to be available nationwide by the end of September. Earlier this month, Walmart reported that about 10% of its shopper population already has access to the newly combined app.

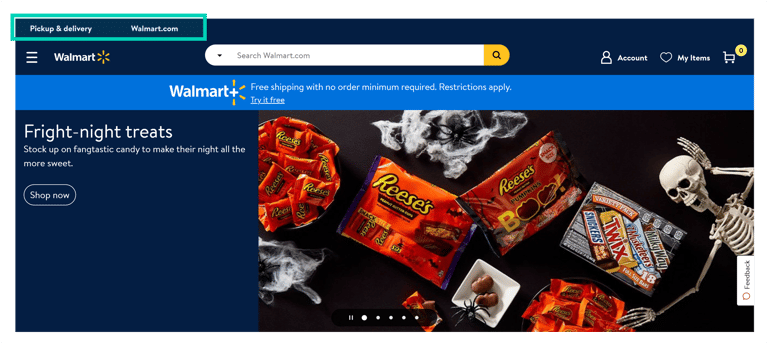

BEFORE — Home page

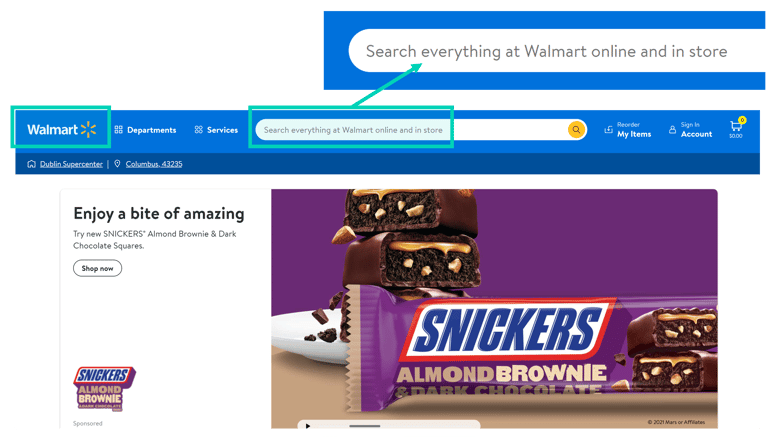

AFTER — Home page

Here we highlight 4 of the biggest changes to the site, potential implications, and what actions brands should be taking.

Change #1: Universal search shakes up search results

BEFORE: Consumers had to choose which of Walmart’s two legacy sites they wanted to shop: Walmart.com national delivery or local pickup and delivery (OPD). Two separate sites meant two separate search assortments and algorithms at work. Search results were based on which site a consumer was shopping.

AFTER: Now the shopper journey takes place on one unified site (or app); no more picking between dotcom and OPD. One site means one search algorithm. Search results feature all available products: what’s available to ship AND what’s at the local store.

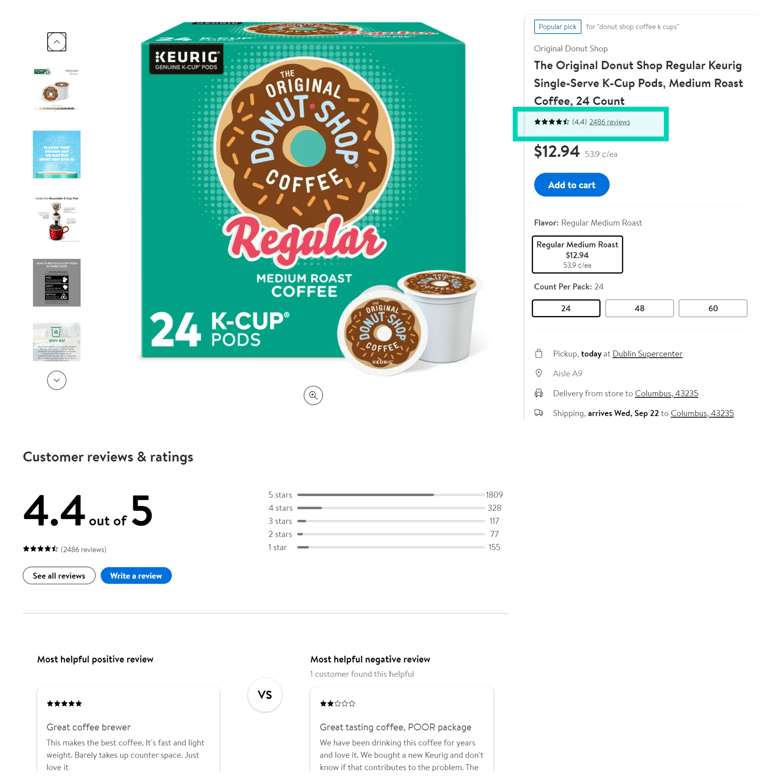

Possible fulfillment methods — 3+ day shipping, Pickup, or Delivery (from store) — are displayed at the bottom of the thumbnail. A filter is available that allows shoppers to select their preferred fulfillment option, which changes the search results and availability (in stock) information. Pricing, promotions, content and reviews do not change when you switch fulfillment methods. Interestingly, the filter can’t be applied at the onset of shopping (i.e., if you only want to shop local pickup or delivery), only after searching for a product.

AFTER — Search results (“mustard”)

SO WHAT? NOW WHAT?

- More than ever, it will be important to measure and set goals for winning search on Walmart. If you’re not already, start tracking share of page 1 placement for your brands and top products. In eCommerce, increasing your share of search is equivalent to gaining more distribution or more facings; it’s directly correlated with sales and market share. Make sure your product content is optimized to win organic search placement.

- A shakeup in search result rankings is inevitable, since more products — those stocked in-store, in warehouses for national ship, and 3P marketplace goods — are now in the search pool on Walmart’s site. This means it’s possible for small challenger brands (currently having distribution only through national ship or via 3P) to gain exposure to Walmart’s core grocery shoppers that they never had before. On top of that, they can also use sponsorship to further boost their visibility. With any luck, they could parlay success into retail store distribution too. All the more reason for brands to keep close tabs on search placement, watching for any signs that product ranking or share of page 1 is declining. If so, you may want to allocate more ad funds to priority products, at least temporarily, to ensure they get top-of-page placement on the new site.

- As with any change in the customer experience, some near-term volatility in sales & share is likely. Keep this in mind as you monitor your Walmart.com sales.

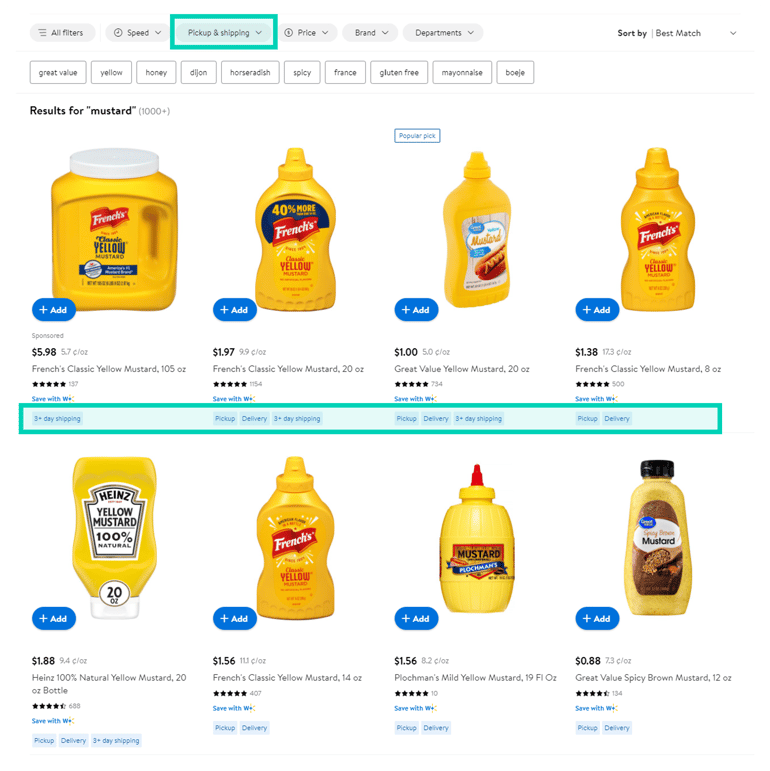

Change #2: Ratings & reviews now available for all grocery products

BEFORE: The former OPD site didn’t support consumer reviews.

AFTER: Product detail pages (PDPs) on the unified site now feature star ratings & reviews for all items, including grocery.

AFTER — Ratings & Reviews on grocery pages

SO WHAT? NOW WHAT?

- Our research shows that Walmart.com’s algorithm favors review count as an important factor driving search. So it only makes sense that Walmart has extended this feature to all products, including formerly OPD-only items. So, if you hadn’t previously invested much in reviews before because it didn’t matter to Walmart OPD, now’s the time to invest. (To learn more about how reviews can boost conversion and sales, see our eCommerce Acceleration Playbook.)

- Anytime a retailer updates its content requirements or adds new capabilities is a good time for your team to review KPIs, and what’s being monitored and managed on a regular basis. Some Ratings & Reviews metrics you will want to track include: review count, average star rating, and review recency or number of new reviews added.

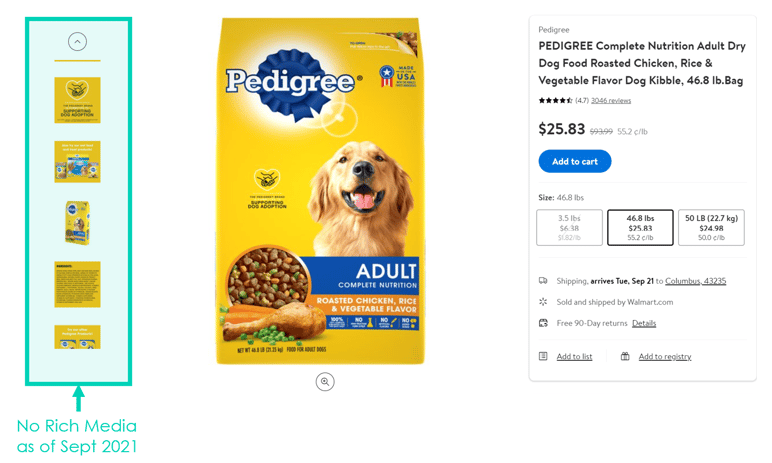

Change #3: Temporary pause on rich media

BEFORE: Previously, brands selling on the Walmart.com national delivery site had the ability to upgrade their PDPs with rich media. This included having videos in the above-the-fold image carousel, and comparison charts and other enhanced “below the fold” options. In contrast, rich media was never an option on OPD.

AFTER: Rich media isn’t supported yet on the new site. But it is expected to return in the near future. A big boon here is that items that were previously OPD-only now will be able to add rich media to their PDPs too.

AFTER — Temporary pause on rich media

SO WHAT? NOW WHAT?

- If you don’t already have rich media, including videos, created for your Walmart PDPs (e.g., if you previously only sold on OPD), it’s time to get busy creating enhanced content. Pay close attention to what your top competitors and category bestsellers are doing. Our research shows brands can lift sales by 58%, on average (on Amazon) when video content is added or improved to meet category bestseller benchmark standards.

- In the interim until rich media returns, get creative with your content and images since there’s no longer an option to convey messaging, use cases, product attributes, etc. through videos, comparison charts or other enhanced manufacturer content right now on Walmart’s new site.

- You should also hit pause on any content goals, incentives and KPIs designed around tracking rich media metrics for Walmart while the feature is unavailable.

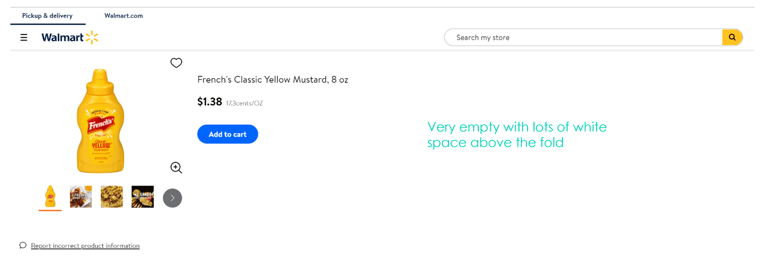

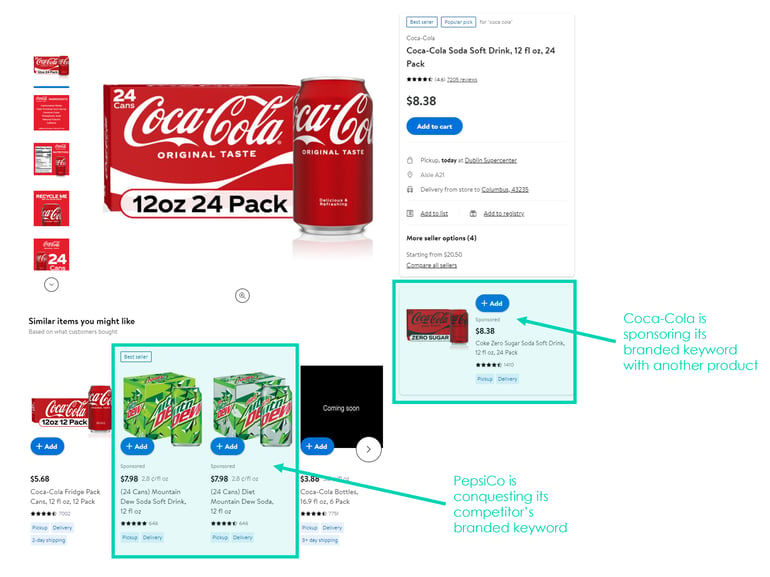

Change #4: More real estate for sponsored ads

BEFORE: Product detail pages on the former OPD site was a bit of a misnomer, since the page was anything but detailed. In fact, above-the-fold space was quite the opposite with lots of empty white space.

BEFORE — OPD product detail page

AFTER: Walmart is now dedicating a lot more prime real estate on its product detail pages to ad space, which is good news / bad news. Good — because you can place more ads on your own pages to protect your keywords or for cross-promotion purposes. You can also bid to place ads on competitors’ product pages too. Bad — because competitors can do the same thing to you.

AFTER — Product detail page (keyword: “coke”)

SO WHAT? NOW WHAT?

- Carefully monitor your PDPs for competitors conquesting your keywords and placing sponsored ads on your product pages. You may need to up your sponsored ad ante to try and staunch this competitive activity.

- Turnaround is fair play. Seek opportunities to conquest competitor keywords and ad placement on their PDPs.

To learn more about how we can help you manage your digital shelf on Walmart’s newly unified site, contact Profitero for a demo.