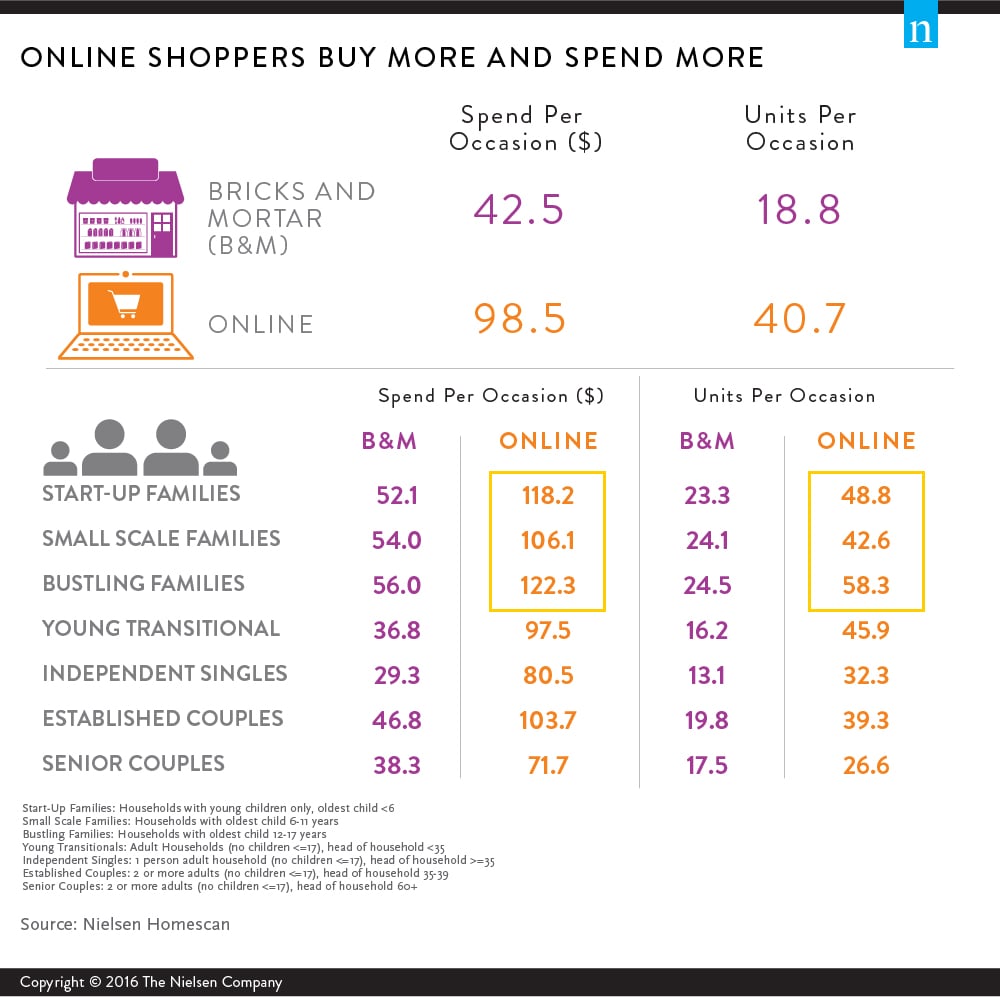

Grocery eCommerce, while still small in Australia, represents a major opportunity for retailers. Nielsen Homescan reveals that the average basket size of an online shopper is close to $100 – more than double that of the average basket shopped in a physical store.

And, with no space constraints and no hassle of packing and unpacking the car, consumers are also inclined to buy more items online. The actual number of items purchased per trip is more than double the regular shopping trip in-store. The majority of online shopping missions are classified as a main shop; but despite larger basket sizes, the number of average trips in a year is still lower than in-store shopping occasions. In most cases, smaller top-up occasions and emergency trips are still made in physical stores.

Driving online growth hinges on encouraging more shoppers to buy online and winning the loyalty of existing online shoppers. In order to do this, retailers need to know how to best build and maintain consumer connections in this rapidly changing eCommerce environment. Better systems, scale, experiences, and experimentation are the keys to growth for brands and retailers.

In a digital world, every product, service and experience must be excellent, personalized and available at a moment’s notice. When it’s not, consumers are more willing and able than ever to find a replacement. This is especially true for Millennials and Gen Z, who are the most likely generations to try new products at the grocery store.

Millennials are 40% more likely to shop online than average. Their importance in value to online is also around 40% more than their contribution to traditional bricks and mortar stores. This is a consistent trend across many developed markets. In France, for example, online grocery is twice more important for millennials than the rest of the population, accounting for 12% of their spend versus 6% for the total market.

Generation X, those consumers aged between 35 and 44, are also becoming more important online grocery shoppers. They are now responsible for almost 40% of what is spent online, up 10 percentage points compared to 2015. Engaging with and meeting the needs of this more mature but modern group is likely to uncover great opportunities for both retailers and brands.

The future of digital retail has always been about making life easy and giving consumers choice. But eCommerce 2.0 will be more experiential as well. Consumers want goods to be more than just products that deliver on price and value. Consumers expect convenience, but they also want a curated and magical experience.

About the Nielsen Grocery eCommerce Report

This report explores the Australian online grocery opportunity by looking at key shopper trends in this channel and other factors shaping in this space, to help our clients and the industry better navigate this channel.

It provides analysis and understanding of today’s eCommerce market and shoppers including: online shopper profiles; digital devices used on the path to purchase; perceptions and attitudes of online grocery shopping; emerging channels; international trends; and strategies for success.