Editor’s note: For more on this topic and the examples below, listen to Spotify’s podcast of the original presentation by Louise Keely, executive vice president and global retail practice leader, Nielsen, from the 2017 Consumer Electronics Show.

For consumer packaged goods (CPG) manufacturers and retailers, knowing how consumers go from wanting to buying along the elusive and increasingly digital path to purchase is critical for two reasons. First, it allows them to measure the market more accurately, so they can make better decisions about where and how to invest for growth. Second, it enables them to engage their customers more effectively, especially as the lines between media and commerce continue to blur. Both understanding consumers’ needs better and knowing which channels will reach them brings companies closer to the points of decision—meaning closer to the coveted sale—during the shopper journey.

But in today’s vast and interconnected digital landscape, there is no longer one “typical” consumer. Over a few short decades, shopping options have expanded from local stores and cash transactions, to chain stores and credit cards, to anytime/anywhere shopping both on and offline, enabled by mobile apps and wallets. And not all shoppers are using every channel equally, especially when it comes to digital.

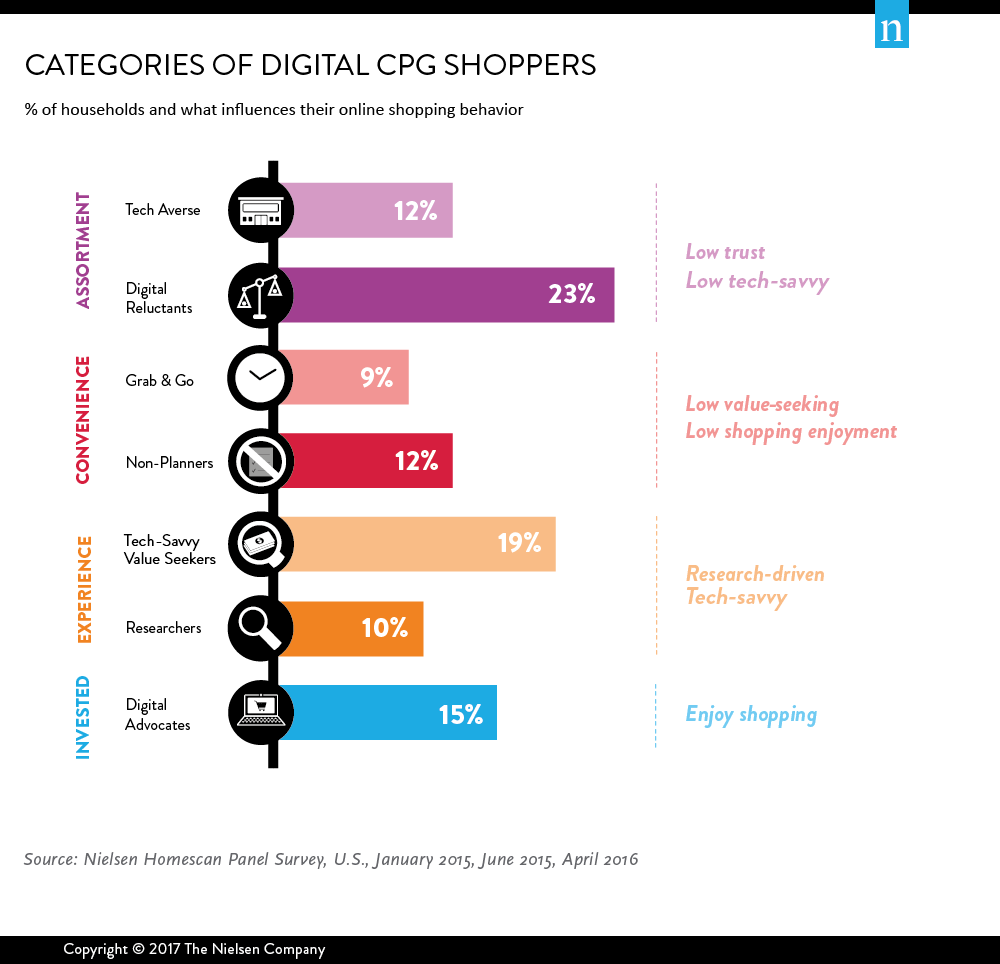

In fact, Nielsen has identified seven broad categories of digital CPG shoppers, each with different motivations and behaviors. Online assortment is a key driver for 35% of U.S. households (technology-averse and reluctant segments), while 21% go digital for convenience (grab & go and non-planner segments), 29% are in it for the experience (tech-savvy value seeker and researcher segments), and 15% are digital advocates fully invested in online shopping.

Not surprisingly, digital advocates heavily over-index (at 214) when it comes to online spending, likely due to their enthusiastic enjoyment of the channel. On the other hand, consumers driven by the convenience of online shopping (grab & go, non-planners) spend roughly what you’d expect via eCommerce channels (indexing at 101 and 100, respectively). Other segments, such as the tech-savvy value seekers, do not buy as frequently online. Instead, they are heavy users of online tools to help them find the right products at the best prices; this ultimately leads to a trip to the store to make the final purchase. Although eCommerce is still in its infancy for CPG (with huge potential for growth), a variety of digital touch points are now influencing shoppers before and beyond the sale. Even at a high level, lots of nuance is evident between these groups’ needs, making it more complex than ever before to decode their unique shopper journeys.

Fortunately, while the explosion of digital technology has made the path to purchase more complex and fragmented, it also offers powerful tools for better understanding that path. Every time a shopper glances at a screen, clicks a button or enters a store, he’s generating thousands of signals that tell the story of what makes him tick, and how to win your way into his heart—and cart.

With more precise consumer data becoming available, manufacturers and retailers can understand consumers in more detail and connect with them more effectively. Consumer measurement and engagement are evolving in four key ways:

- Person-level observation: Following consumers’ use of technology to gain a detailed, privacy-friendly view of their behavior across physical and digital boundaries, like whether or not online ads are driving viewers to the store.

- Integrated measurement: Combining data sets to reveal new insights, such as blending weather, stock market information and economic activity to forecast consumer demand.

- More ways to reach: Finding new opportunities to connect with consumers along their unique paths to purchase, like virtual stores that cater to convenience-focused consumers on the go.

- Improved engagement: Using personalization, such as contextual coupons and customized shopping maps, to build more loyal customer relationships.

These transformations will enable savvy industry players to keep up with the multitude of new paths to purchase as digital technology continues to revolutionize retail. Ultimately, the entire ecosystem will benefit from the blend of advanced measurement and better engagement: consumers will enjoy better prices, more innovative products and more relevant marketing, while CPG companies and retailers will see stronger market success and better return on their investments.

Download the Swipe to Buy report for additional insights on the future of digital commerce within the CPG and retail landscape.

METHODOLOGY

The insights in this article were derived from:

- Nielsen Homescan Panel survey, U.S., January 2014, June 2015, April 2016

- Nielsen 2016 U.S. Homescan Panel Digital Segmentation Survey

To stay up-to-date on the latest eCommerce news, you might also be interested in signing up to Profitero’s weekly Digital Shelf Digest.